Zhao Changpeng Rises Again to Top of Chinese Billionaires, The Man is Back

2025-06-10 18:30

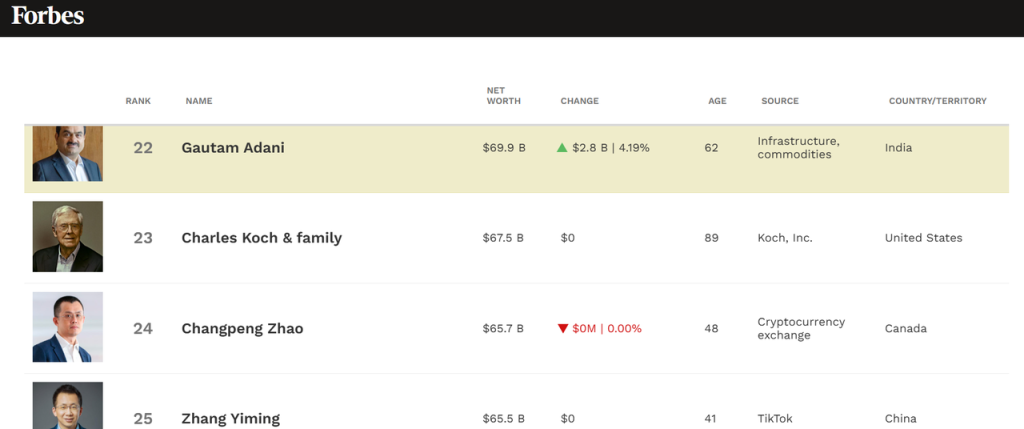

Today, the Forbes Global Rich List was announced, with CZ, the founder of Binance, becoming the richest Chinese person again after four years, surpassing Zhang Yiming, with an asset value of 65.7 billion USD (approximately 475 billion RMB).

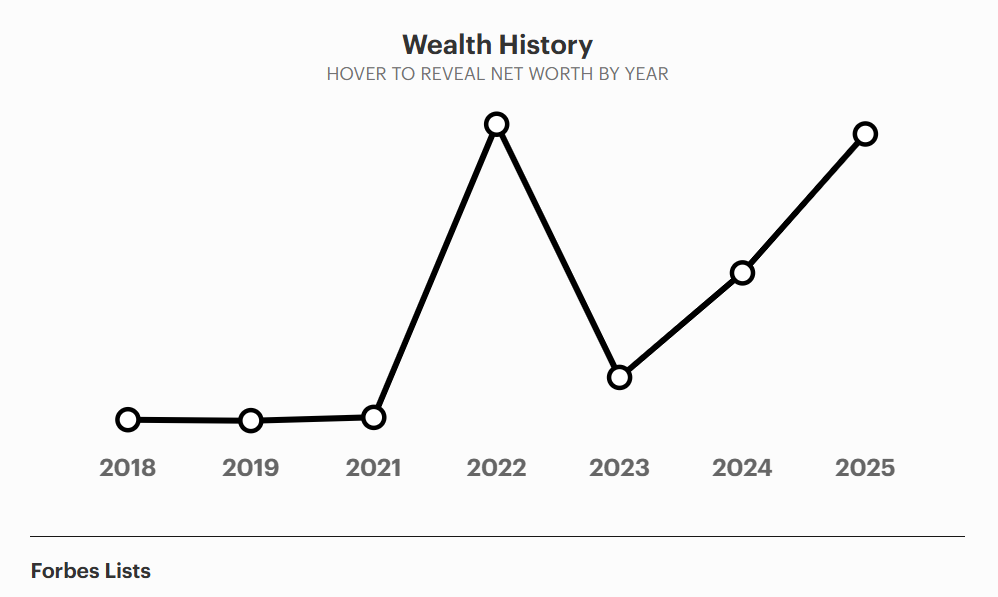

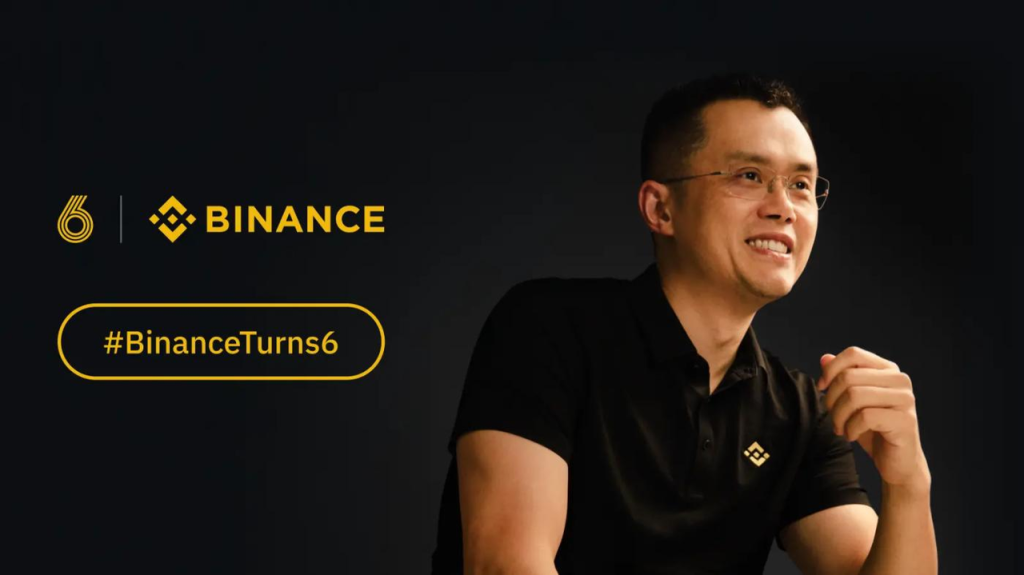

This news shocked the global crypto market and brought this crypto leader, who had temporarily stepped out of the public eye due to regulatory issues, back into the spotlight. From December 2021, when CZ first became the richest Chinese person with a net worth of 90 billion USD, to 2023, when he resigned as CEO due to Binance compliance issues, and then to 2024, when he was imprisoned, CZ's life trajectory has been as turbulent as the crypto market.

This return not only marks his personal financial rebound but also reflects the crypto industry's rebirth through the struggle between regulation and technology. Additionally, Bitcoin has once again hit 110,000 USD today, and many things seem to be heading in a positive direction.

CZHow did his wealth return?

In September 2024, CZ completed his four-month sentence for violating the U.S. Bank Secrecy Act, paid a personal fine of 50 million USD, and Binance paid a record 4.3 billion USD settlement fee—among the highest corporate fines in U.S. history. At that time, the market generally expected a downturn: the founder in prison, regulatory pressure, and shrinking market share. However, during this most difficult year, Binance withstood the pressure.

This crisis forced Binance to accelerate its compliance process: moving U.S. users to the independent entity Binance US, collaborating with Asian institutions to provide liquidity support, and establishing partnerships with over 20 regulatory authorities. In 2025, Binance maintained its leading position in the market through the "Three-Stage Compliance Management Method" (account tiered management, transaction behavior optimization, information synchronization mechanism) under increasingly strict regulations.

Binance's spot market share in Q1 2025 remained stable at 40%-44%, and its derivatives market share exceeded 35%, firmly holding the top position in the industry. Its spot trading volume was higher than the combined total of platforms ranked 2nd to 6th, and it is absolutely leading in liquidity, compliance layout, and ecosystem development.

In 2025, the cryptocurrency market experienced a full recovery after the "Crypto Winter" of 2022. Bitcoin's price surged from a low of 16,000 USD in 2022 to 100,000 USD, while BNB (Binance Coin) broke through 700 USD, maintaining a top three market cap globally. As the world's largest cryptocurrency exchange, Binance has a daily trading volume exceeding 100 billion USD, accounting for 40.7% of the global market share. The application scenarios of BNB, the ecosystem token of Binance, have expanded to multiple fields such as payments, on-chain ecosystems, and investment tools.

CZ holds approximately 30% of Binance's equity, and his personal wealth is directly proportional to Binance's valuation. Taking Coinbase as an example, its market capitalization rose from 19 billion USD in 2024 to 46 billion USD. While Binance maintained its basic position, as an industry leader that is not publicly listed, it often enjoys a higher valuation premium during the crypto bull cycle.

Aside from Binance equity, CZ's wealth also comes from long-term holdings of crypto assets. In 2013, he sold his Shanghai property and fully invested in Bitcoin. This "bet" yielded extraordinary returns in 2025. Additionally, due to the anonymity of crypto assets—large amounts of BNB and BTC are scattered in anonymous wallets, not covered by statistics.

CZPersonal Activities After Release

Despite stepping down as CEO of Binance, CZ remains deeply tied to the company's fate as a major shareholder, shifting his role to a more hidden ecosystem enabler.

Capturing MEME Trends, Binance Alpha Dominates the Market

Within 170 days of his release, he posted 363 tweets, increasing his daily posting rate by 37%. Through a three-pronged approach of "tweet interaction - community creation - on-chain operations," he led several popular Meme coins on the BNB Chain. For example, after the Abu Dhabi Sovereign Wealth Fund MGX invested 2 billion USD in Binance, he leveraged the momentum to promote the Meme coin MUBARAK, bringing Binance's on-chain ecosystem back to its peak.

Transition from Technology Evangelist

His investment focus shifted to AI, biotechnology, and decentralized science (DeSci). He promoted DeSci with Vitalik in Bangkok, drove Binance Labs to invest in the research data rights project Bio Protocol, and attracted traditional researchers to join Web3.

Multiple Supports for Industry Development

Binance's strategic focus shifted toward the deep integration of AI and blockchain. He stated, "AI is the eyes of blockchain, and blockchain is the hands and feet of AI. Their combination will reshape the economic operating system." In 2025, the cryptocurrency market faced dual challenges of "quantum computing threats" and "regulatory gray rhinos." CZ emphasized, "Compliance is not the end, but the ticket to enter the mainstream financial system."

Current Market Analysis

Recent multiple positive factors have driven the market to a strong rebound. The 110,000 target mentioned last Friday was reached in just a few days, stronger than expected. So how should we view the current market situation?

The market has been in a washout phase since May, especially for altcoins and ETH, which have been in a washout for a month. It now has the conditions to trigger a new round of market movement. Technically, the moving averages have returned to coupling, and the bulls are still gathering strength. Of course, there is no denying the possibility of another washout, but the washout is close to its end. Overall, I will continue to hold, and if BTC falls to the first support level, pay attention to 105,000-108,000; ETH focus on 2,500-2,600.

Author: Aaron, ChainThink

Editor: Charlie, ChainThink

Disclaimer: Contains third-party opinions, does not constitute financial advice

Alpha Research

Alpha New Token Research Report, Binance Alpha Operation Suggestions

Popular Airdrop Tutorial

Selected potential airdrop opportunities to gain big with small investments

Crypto-linked Stocks

Crypto-stock linkage, real-time market quotes and in-depth analysis

Market Analysis

BTC/ETH, Major Cryptocurrencies, and Hot Altcoins Price Trends

Regulatory Watch

American Crypto Act – timely interpretations of policies worldwide

Frontier Insights

Spotlight on Frontier, trending projects, and breaking events

Crypto Weekly

Tracking on-chain movements of the smart money and institutions

ChainThink App

WeChat Official Account

WeChat Customer Service