Uniswap's Landmark Proposal Moves Toward Compliance: Is a Second Spring for UNI on the Horizon?

2025-08-12 17:28

Uniswap, the largest decentralized trading platform on Ethereum, is planning to equip its governance organization with a legal "armor." On August 11th, the Uniswap Foundation (UF) submitted a proposal to the community, suggesting that Uniswap DAO be registered as a Wyoming DUNA (Decentralized Unincorporated Nonprofit Association) and that a new entity named DUNI be established.

If approved, Uniswap DAO will become the largest decentralized organization to adopt this framework to date. This is not only a crucial step toward DAO compliance but may also provide a legal foundation for the long-pending "fee switch."

DUNA: The "Legal ID" and Shield for DAOs

1. The Global Context of Legalization

Decentralized autonomous organizations (DAOs) emphasize on-chain self-governance and permissionless participation, but this model often lacks legal entity status within existing legal frameworks. Without legal identity, DAOs cannot sign contracts, hire lawyers or accountants, open bank accounts, or even act as independent entities in legal disputes.

Wyoming took the lead in 2021 by introducing the DAO LLC Act, offering chain-based organizations the structure of a limited liability company. In March 2024, the state further launched the DUNA Act, allowing non-profit DAOs to gain legal recognition with a more lightweight structure. This legislation is regarded as a milestone in global DAO compliance.

For ordinary investors, DUNA can be understood as a legal ID + protective shield for DAOs:

- Legal ID: After registration, a DAO can sign contracts with law firms and audit institutions, and file tax returns with authorities, just like a company.

- Protective Shield: Members are no longer personally liable for the DAO’s legal and tax issues. It’s like purchasing "governance insurance"—in the event of legal disputes or tax arrears, risks are borne by the entity rather than individual wallets.

- Operational Upgrade: Under the DUNA framework, DAOs can hire service providers, retain professional advisors, and manage funds and compliance matters more efficiently.

- Simplified Understanding: DUNA is a bridge for DAOs to move from the "gray area" to "legitimacy and compliance," preserving the principles of decentralization while securing real-world operational safeguards.

Proposal Details: Funding Allocation and Execution Mechanisms

The establishment of DUNI will be accompanied by a series of funding arrangements and management structures:

- 16.5 million USD equivalent in UNI: To cover historical tax arrears (estimated at less than 10 million USD) and establish a legal defense budget.

- 75,000 USD equivalent in UNI: Paid to Wyoming-based company Cowrie, responsible for tax filings and financial report preparation. Cowrie co-founder David Kerr participated in drafting the DUNA Act.

- Role of Uniswap Foundation: To act as DUNI’s ministerial agent, responsible for document submission, contract signing, and service provider hiring.

- Role of Cowrie: To serve as DUNI’s administrator, providing ongoing tax and financial compliance services.

Notably, organizations under the DUNA framework cannot distribute dividends to members unless they are reasonable service compensation or cost reimbursements. This means that even if the fee switch is activated in the future, funds flowing into the DAO treasury cannot be directly distributed to token holders; instead, they must be allocated to public expenses, research and development, or incentives through governance decisions.

Fee Switch: A Potential Revenue Engine

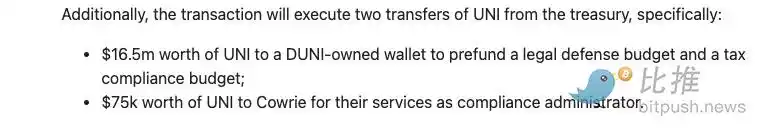

The fee switch is a reserved feature in the Uniswap protocol that can redirect a portion of liquidity providers’ (LP) fee revenue to the DAO treasury. For example, out of the existing 0.3% trading fee, 0.05% could be routed to a DAO-controlled pool.

According to DefiLlama data, Uniswap users paid over 123 million USD in swap fees in the past month. Even redirecting just 1/6 of this to the DAO would mean approximately 20.5 million USD in monthly revenue, exceeding 240 million USD annually. This would significantly enhance UNI’s governance and fund allocation capabilities.

Over the years, multiple proposals for the fee switch have been shelved due to compliance risks. Uncertainties in U.S. securities laws create potential legal risks in directly distributing protocol revenue to token holders. The DUNA framework is seen as a key step in resolving this legal barrier.

Governance and Power Dynamics: Clash Between DAO Ideals and Reality

While DAOs are ideologically decentralized, Uniswap’s governance reality is far more complex than it appears.

1. Controversies Over Power Concentration

U.S. Congressman Sean Casten noted in Congress that the Uniswap Foundation can unilaterally influence governance directions, potentially undermining its decentralized nature. Although UF denies holding excessive power, major proposals are often initiated and promoted by the foundation, with community proposals having relatively low approval rates.

2. Influence of Venture Capital

In 2023, UF withdrew a fee switch proposal after a stakeholder raised new concerns. Paradigm partner Dan Robinson accused this of capitulating to large venture capital firms, with public opinion widely speculating the party was a16z. Notably, a16z publicly praised DUNA as an "oasis for DAOs," sparking concerns among some community members that legalization might strengthen capital influence.

3. Balancing Decentralization and Efficiency

In on-chain governance, decentralization and decision-making efficiency are often mutually exclusive. Some projects (e.g., LayerZero Foundation, Yuga Labs) have opted to re-centralize 部分权力 to improve execution efficiency. Uniswap’s DUNA proposal, to some extent, seeks this balance.

On the day the proposal was announced, UNI rose nearly 8% in the short term before retracing, indicating market optimism about compliance and revenue reforms. However, historical data shows UNI remains at a low level:

- All-Time High (ATH): $44.97 on May 2, 2021

- Current decline from ATH: Approximately -75.76%

On-chain data reveals Uniswap maintains its leading position among decentralized trading platforms across Ethereum, Polygon, Arbitrum, Optimism, etc., with monthly trading volumes stabilizing between 30 billion to 50 billion USD. However, the low value capture rate of protocol revenue has long been a valuation bottleneck for UNI.

Outlook: Compliance or Power Restructuring?

If the initial vote on August 18th passes, Uniswap DAO will join the first batch of large decentralized organizations adopting the DUNA framework. This could mark a milestone in industry compliance and reshape UNI’s value capture logic.

Opportunities and risks coexist:

- Positives: Compliance reduces legal risks, and the activation of the fee switch is expected to bring stable capital inflows, strengthening UNI token’s value support.

- Potential Challenges: Power concentration and capital influence may exacerbate governance divisions within the community.

For investors, the DUNI proposal is not just a governance restructuring but an industry experiment on "how DAOs mature." The outcome will impact not only Uniswap’s future but may also provide a blueprint for balancing compliance and decentralization across the entire DeFi sector.

Author: Bitpush