Coinbase Under Pressure from Robinhood: How Did COIN Overcome Difficulties Time and Again?

2025-08-12 12:03

Recently, Robinhood's market value exceeded the $100 billion mark, while Coinbase's market value fell back to $82 billion. The rivalry between these two largest U.S. financial service providers has attracted more attention. In terms of year-to-date performance, Robinhood has risen by 135%, compared to only 30% for Coinbase, with most of Coinbase's gains coming in the past month. Coinbase has been questioned for its sluggish growth after losing its compliance halo. However, it has begun to step up efforts across multiple business lines. As the first exchange giant to list on Nasdaq, how did it overcome difficulties time and again? Can it successfully retain its position as the leading listed player this time?

Inception

In 2012, Brian Armstrong, an engineer at Airbnb, created a small website in his shared apartment in San Francisco with the goal of "allowing anyone to buy Bitcoin with one click." A few weeks later, he met Fred Ehrsam, a former Goldman Sachs trader, on Hacker News. The two joined Y Combinator (YC) and launched Coinbase with a mission: to make the entry point to cryptocurrency as simple as using email.

In 2013, both funding and reputation took off: Union Square Ventures (USV) led its Series A round, and Andreessen Horowitz (a16z) followed with a Series B investment. Its catchy slogan—"The simplest way to buy Bitcoin"—resonated widely. By integrating ACH/bank card payments to reduce waiting times and failure rates, Coinbase provided the first "official channel" for U.S. retail investors to access cryptocurrency.

Rapid Growth

Subsequently, Coinbase took the initiative to embrace KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, establishing a compliance team to adopt a "ask first, list later" approach instead of pursuing reckless growth. In 2015, it brought in traditional financial shareholders such as the New York Stock Exchange (NYSE) and USAA in its Series C round, securing a three-pronged advantage: licenses, banking relationships, and clearing/settlement capabilities.

It then expanded its product line:

- Coinbase Exchange/GDAX (later merged into Advanced Trade) for professional traders;

- Coinbase Custody, which obtained a New York trust license to provide institutional custody services;

- A partnership with Circle to launch USDC, a stablecoin infrastructure.

The platform aimed to serve not only retail investors but also institutions.

By this point, a business flywheel had formed: fiat currency deposits → spot trading/custody → over-the-counter (OTC)/institutional services → compliance of listed assets. Coinbase used a "whitelist mindset" to screen projects, sacrificing speed for compliance credibility—a defining difference from most exchanges worldwide.

In 2021, Coinbase made its debut on Nasdaq through a direct listing (ticker: COIN). Without traditional underwriters setting the price, all historical shareholders and employees directly entered the secondary market to "prove their worth." This marked the first time a cryptocurrency exchange itself stepped into the spotlight of a major U.S. stock exchange.

Surviving the Winter

The industry winter was equally harsh: in 2022, liquidity dried up, the company downsized to control costs, and regulatory investigations intensified. Coinbase upgraded its positioning from a "trading platform" to "compliant infrastructure," maintaining institutional trust through transparent disclosure, risk isolation, and regular auditing and reporting—relying on a "clean ledger."

It fought back to overcome growth stagnation with two key strategies:

- Base blockchain: A Layer 2 solution built on OP Stack, focusing on "low fees, ease of use, and compliance friendliness." Through "Onchain Summer," it attracted creators and brands to the chain.

- International derivatives: Offering perpetual contracts and other tools to non-U.S. users, completing its product matrix.

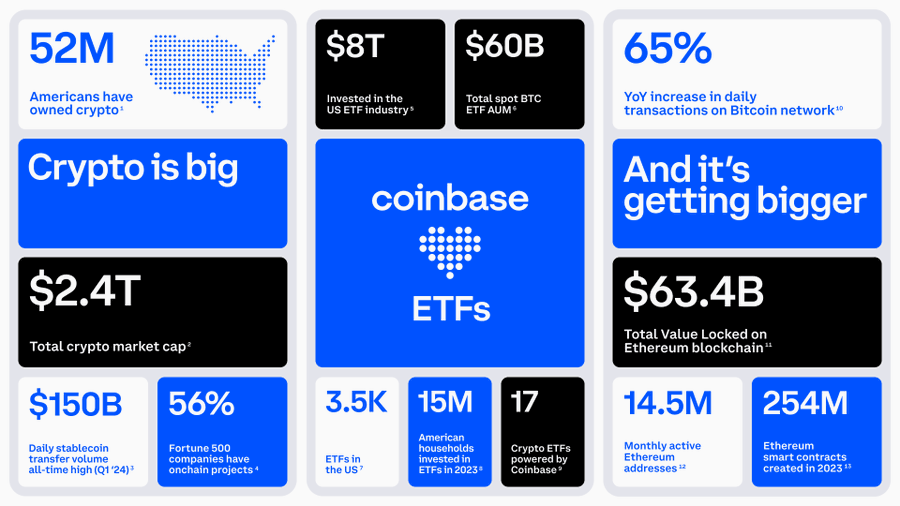

Its "custody business" evolved into a super channel: starting in 2024, multiple U.S. spot Bitcoin ETFs chose Coinbase for custody and clearing services. Compliance thus became a distribution channel—ETFs, institutions, and compliant funds use it to "enter the chain," making Coinbase more like a "cryptocurrency version of a clearinghouse and bank."

We can see that Coinbase's true product is not trading, but a "trusted entry point." From a small YC team to building its own Layer 2 and hosting ETFs, its compliance moat is not easily breached. Perhaps when both compliant funds and developers enter the chain, the entry point will be more than just a buy/sell button—it will be the interface of new finance.

A New Round of Fierce Competition

Craig Siegenthaler, an analyst at Bank of America, recently raised Robinhood's target price to $119 while lowering Coinbase's from $383 to $369, arguing that "Robinhood's crypto revenue is surging, while Coinbase relies too heavily on volatile altcoin trading, which retail users are abandoning." Robinhood's rapid growth has put pressure on Coinbase.

Additionally, Kraken has seen the most significant growth in U.S. market share this year and is rumored to be planning a U.S. IPO. Exchanges like OKX and Bullish are also close behind. As regulatory and compliance channels open up, Coinbase faces more direct competitors.

Currently, Coinbase's global market share has dropped from 5.65% to 4.56%, with a slight recovery in July. It faces a dilemma: lowering fees would hurt profit margins, while maintaining high fees risks losing traders. We wait to see what exciting blockchain stories these service providers will tell in the upcoming fierce competition.

Original Author: @KKaWSB

Adapted by: ChainThink