ChainThink

Stay ahead, master crypto insights

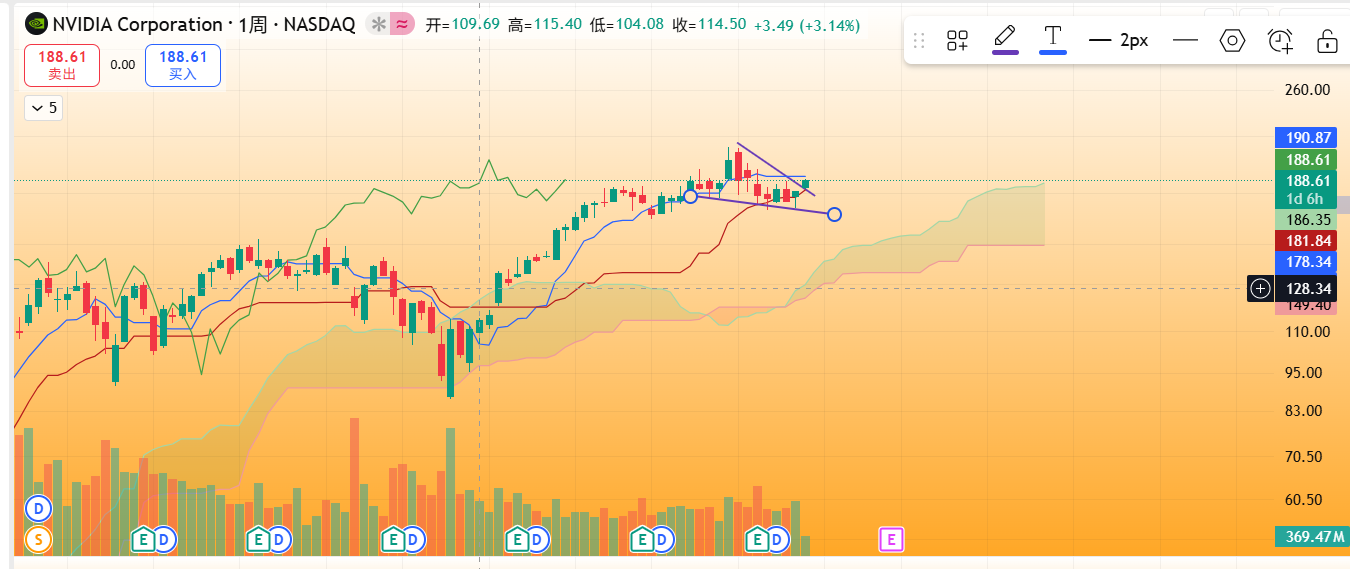

NVDA US Stock Signal (Short-term): Kumo Cloud Conversion Line Resistance + Wedge Consolidation Breakout, Support near $180, Resistance at $191

NVDA US Stock Signal (Short-term): Kumo Cloud Conversion Line Resistance + Wedge Consolidation Breakout, Support near $180, Resistance at $191

2025-12-25 23:18

ChainThink report: On December 25, AI-powered technical analysis indicates that after NVDA (Nvidia) U.S. stocks reached a bottom at $170 on December 18, they have rebounded to date. In the short term, near-term resistance lies at the weekly Ichimoku Kinko Hyo conversion line and daily cloud resistance, with strong resistance at $191. A positive sign is that the daily chart has already broken above the upper boundary of the wedge consolidation pattern with increased volume, and MFI has also crossed upward. If the price retests $180 without breaking below it, the overall trend remains bullish; however, a break below $180 could trigger a test of the potential neckline at $168, corresponding to a head-and-shoulders top pattern.

If $180 remains unbroken, then after surpassing $191, the next target is $200. (AI analysis, not investment advice, validity period 2–8 days)

Disclaimer: Contains third-party opinions, does not constitute financial advice

Alpha Research

Alpha New Token Research Report, Binance Alpha Operation Suggestions

Popular Airdrop Tutorial

Selected potential airdrop opportunities to gain big with small investments

Crypto-linked Stocks

Crypto-stock linkage, real-time market quotes and in-depth analysis

Market Analysis

BTC/ETH, Major Cryptocurrencies, and Hot Altcoins Price Trends

Regulatory Watch

American Crypto Act – timely interpretations of policies worldwide

Frontier Insights

Spotlight on Frontier, trending projects, and breaking events

Crypto Weekly

Tracking on-chain movements of the smart money and institutions

ChainThink App

WeChat Official Account

WeChat Customer Service