ChainThink

Stay ahead, master crypto insights

Analysis: After the sharp drop on October 11, long-term holders executed a historic distribution, marking a significant shift in BTC's cost basis structure

Analysis: After the sharp drop on October 11, long-term holders executed a historic distribution, marking a significant shift in BTC's cost basis structure

2025-12-22 14:59

View OriginalChainThink report, December 22: On-chain data analyst Murphy identifies the October 11 crash as the starting point of this downturn, analyzing significant shifts in BTC's cost basis structure over the past two months as follows:

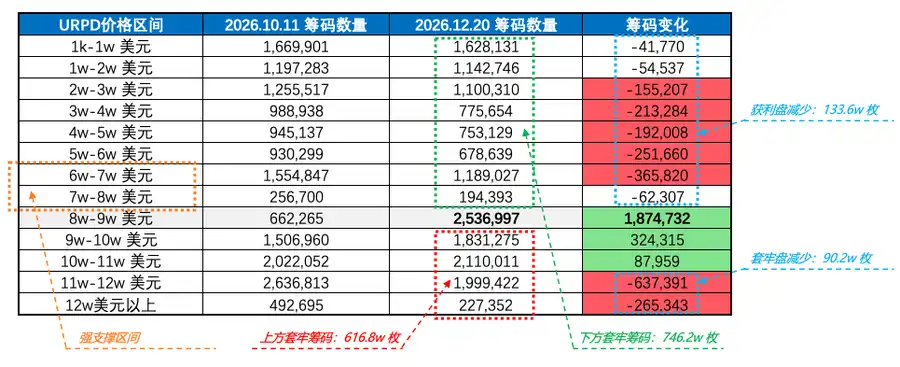

The most concentrated BTC accumulation zone lies between $80K and $90K, totaling 2.536 million BTC—an increase of 1.874 million BTC since October 11—currently representing the strongest support level. Next is the $90K to $100K range (up 324,000 BTC), followed by $100K to $110K (up 87,000 BTC).

Using BTC’s current price as the midpoint, there are 6.168 million BTC above the break-even point with unrealized losses, and 7.462 million BTC below with unrealized gains. Excluding Satoshi’s holdings and long-lost BTC, the current market is nearly at equilibrium in terms of distribution structure.

From October 11’s crash through December 20, the number of profitable positions below the current price decreased by 1.33 million BTC, while the number of trapped positions above $110K dropped by 902,000 BTC. Conversely, BTC held within the $100K to $110K cost range did not decline but instead increased by 87,000 BTC. This indicates that top-tier holders have largely been liquidated, with the remainder now in a "flat" or dormant state.

Profit-taking is accelerating, driven by the four-year cycle thesis, macroeconomic uncertainty, and emerging concerns such as quantum threats—all prompting long-term holders to execute what may be an epic distribution phase. The largest volume of sell-offs originates from BTC accumulated in the $60K to $70K cost range, primarily built up ahead of the 2024 U.S. presidential election. With profits significantly eroded, these holders are now rushing to cash out.

The $70K to $80K range currently represents a relative "void zone," containing only 190,000 BTC. A minimal fraction of market participants hold BTC at these levels. Should prices fall into this zone, it could attract substantial new liquidity, potentially generating strong support.

Disclaimer: Contains third-party opinions, does not constitute financial advice

Alpha Research

Alpha New Token Research Report, Binance Alpha Operation Suggestions

Popular Airdrop Tutorial

Selected potential airdrop opportunities to gain big with small investments

Crypto-linked Stocks

Crypto-stock linkage, real-time market quotes and in-depth analysis

Market Analysis

BTC/ETH, Major Cryptocurrencies, and Hot Altcoins Price Trends

Regulatory Watch

American Crypto Act – timely interpretations of policies worldwide

Frontier Insights

Spotlight on Frontier, trending projects, and breaking events

Crypto Weekly

Tracking on-chain movements of the smart money and institutions

ChainThink App

WeChat Official Account

WeChat Customer Service