Gray Market and TAOX Launch Joint Efforts, Bittensor Sees Institutional Moment

2025-10-15 11:33

On October 10, Grayscale Investments submitted a Form 10 registration statement for the Bittensor Trust (TAO) to the U.S. Securities and Exchange Commission (SEC), opening the door for this AI-centric crypto asset trust to become compliant and enter the public market. If approved, the private placement period for trust shares will be shortened from 12 months to 6 months, meaning early investors will gain liquidity faster and creating conditions for institutional funds to enter.

Several days later, TAO Synergies Inc., a U.S. listed company (Nasdaq: TAOX), announced the completion of an $11 million private placement financing, with investors including James Altucher, TAO's strategy advisor, and Digital Currency Group (DCG), the parent company of Grayscale. This news quickly ignited market confidence — in the past week, TAO's price rose from $290 to $457, a gain of over 50%.

At a time when AI has become one of the strongest narratives on Wall Street, TAO is gradually being seen as a bridge between regulated finance and decentralized AI networks. Market sentiment is high, trading activity is rising, and TAO has not only become a "new AI asset" in the eyes of institutions, but also has the potential to set a new historical high since April 2024.

What Does Form 10 Mean

The so-called Form 10 is a registration document under Section 12(g) of the U.S. Securities Exchange Act of 1934, with the full name General Form for Registration of Securities. When a trust or fund product submits a Form 10 to the SEC and it is accepted, it means that it upgrades from a "private trust" to a "SEC reporting company," and must fulfill the same information disclosure obligations as a publicly listed company — including regular submission of 10-K (annual report), 10-Q (quarterly report), and 8-K (temporary reports). In other words, once the Form 10 becomes effective, the TAO trust will be formally incorporated into the U.S. mainstream securities regulatory system for the first time.

Similar to Grayscale's Bitcoin Trust (GBTC) and Ethereum Trust (ETHE), the TAO Trust aims to list on the OTC Markets over-the-counter market, allowing traditional investors to directly allocate the asset through their brokerage accounts. Looking back at Grayscale's path: GBTC submitted a Form 10 in 2019, ETHE followed in 2020, and both subsequently transitioned into spot ETFs. TAO's current actions are following the same trajectory.

For TAO, this action has three significances:

Shortening the liquidity cycle. The holding period is reduced from 12 months to 6 months, meaning that previously locked private shares can now circulate more quickly in the secondary market, releasing capital for early investors and activating trading depth.

Opening a compliance entry. Once the registration becomes effective, the trust can be listed and quoted on the OTC Markets over-the-counter market, allowing traditional brokers and family offices to invest in TAO as a security without directly accessing crypto wallets or custodial services.

Laying the foundation for ETF transformation. Grayscale has already validated the path of "Form 10 → ETF" with its BTC and ETH trusts. Form 10 is the starting point of this process, paving the way for future applications for exchange-traded products (ETPs).

"TAO Micro Strategy" Strikes Again

On October 14, TAO Synergies Inc., a U.S. listed company (Nasdaq: TAOX), announced the completion of an $11 million private placement financing, with investors including TAO's strategy advisor James Altucher and Digital Currency Group (DCG), an early supporter of Bittensor.

The company was formerly a biotechnology firm, Synaptogenix. After completing a strategic transformation in July, it made its first purchase of 29,899 TAO tokens, valued at approximately $10 million. As of now, TAOX has become the largest holder of TAO tokens globally, with all holdings included in the company's treasury. It plans to stake the tokens on the Bittensor mainnet to participate in network computing and model training, generating long-term returns. Since its transformation in July, the company's stock has risen more than threefold, remaining resilient despite general declines in DAT companies.

James Altucher, TAO's strategy advisor, stated: "This financing further solidifies TAO Synergies' long-term strategy, which includes not only the holding and management of TAO tokens, but also opportunities to generate income and accumulate influence within the Bittensor ecosystem. We welcome DCG's participation — it is a leader in the crypto industry and one of the earliest supporters of Bittensor. We are confident in the future of decentralized intelligence and believe that Bittensor's network model will become a key driver of innovation and value creation in the coming years."

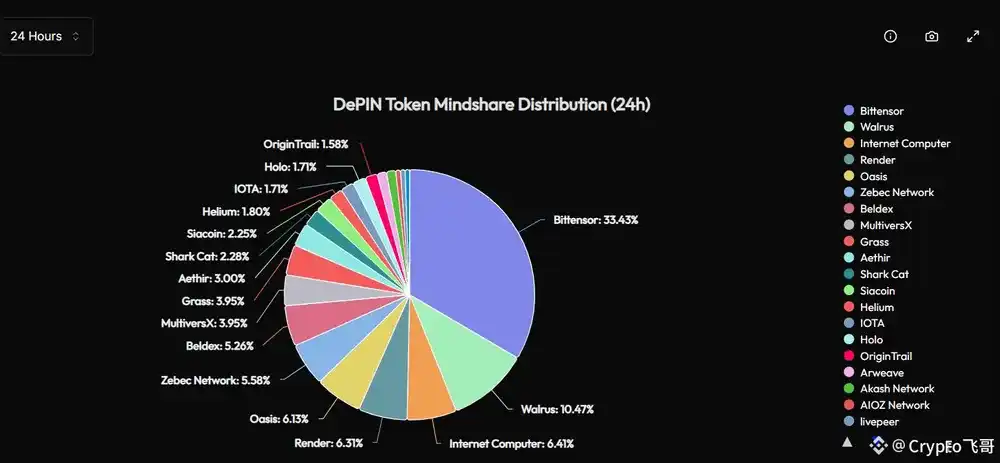

On-chain data shows that Bittensor's market share in the DePIN (decentralized physical infrastructure) sector has exceeded 33%. With the acceleration of institutional fund deployment, TAO is gradually transitioning from a mere "AI concept coin" to a foundational asset with real network value and cash flow models. The market generally believes that the dual actions of TAOX and Grayscale have become a pivotal turning point for institutionalization in the AI sector.

Summary

As the enthusiasm for AI narratives on Wall Street continues to heat up, from NVIDIA to OpenAI, and then to Bittensor, this AI wave is rapidly spreading to the crypto market, and TAO has become a core beneficiary. The redesigned incentive mechanism of dTAO, the approaching first halving, and TAO is expected to challenge the historical high of $1,247 again. After the golden decade of Bitcoin, the AI narrative may become the next capital consensus, and TAO is standing at the beginning of this new era.

Disclaimer: Contains third-party opinions, does not constitute financial advice

Alpha Research

Alpha New Token Research Report, Binance Alpha Operation Suggestions

Popular Airdrop Tutorial

Selected potential airdrop opportunities to gain big with small investments

Crypto-linked Stocks

Crypto-stock linkage, real-time market quotes and in-depth analysis

Market Analysis

BTC/ETH, Major Cryptocurrencies, and Hot Altcoins Price Trends

Regulatory Watch

American Crypto Act – timely interpretations of policies worldwide

Frontier Insights

Spotlight on Frontier, trending projects, and breaking events

Crypto Weekly

Tracking on-chain movements of the smart money and institutions

ChainThink App

WeChat Official Account

WeChat Customer Service