Tom Lee shouted "The fair value of ETH is $60,000", Andre Kang retorted "Like an idiot"

2025-09-25 11:33

Original Title: Tom Lee's ETH Thesis is Retarded

Editor's Note: Since Tom Lee became the Chairman of the Board of BitMine and pushed the DAT to continuously buy ETH, Tom Lee has become the top bullish in the industry for ETH. In recent public appearances, Tom Lee has repeatedly emphasized the growth expectations of ETH with various logics, even boldly stating that the fair value of ETH should be 60,000 USD.

However, not everyone agrees with Tom Lee's logic. Partner Andrew Kang of Mechanism Capital recently published a long article, publicly refuting Tom Lee's views and directly mocking him as "a fool."

As a supplement, Andrew Kang had predicted that ETH would fall below 1,000 USD during the market correction in April this year. He also expressed bearish views during the subsequent ETH price increase... Position determines mindset, so his stance may be at the opposite end of Tom Lee's. It is recommended that readers view it dialectically.

The following is the original content of Andrew Kang, translated by Odaily Star Daily.

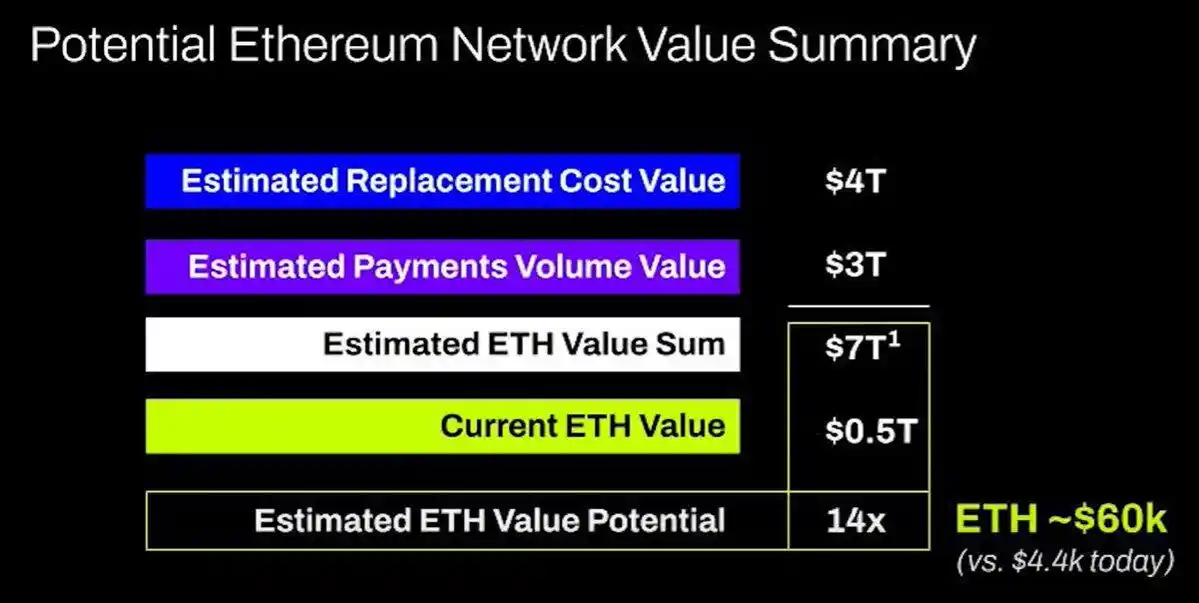

In the financial analyst articles I have read recently, Tom Lee's ETH theory ranks among the "most stupid." Let's analyze his views one by one. Tom Lee's theory is mainly based on the following points.

· Adoption of stablecoins and RWA (Real World Assets);

· Analogy to "Digital Oil";

· Institutions will purchase and stake ETH, providing security for the network where their assets are tokenized, and also as working capital;

· ETH will be equivalent to the total value of all financial infrastructure companies;

· Technical analysis;

One, Adoption of Stablecoins and RWA

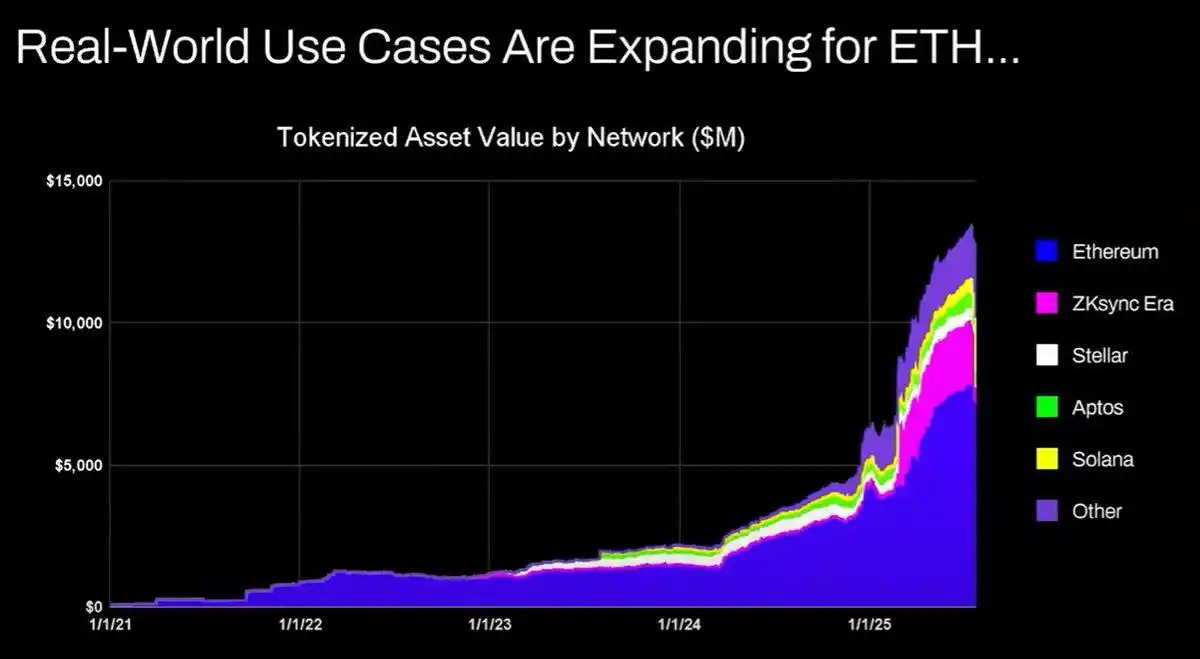

Tom Lee's argument is that the increase in stablecoins and asset tokenization activities will boost transaction volume, thereby increasing ETH's transaction fees. On the surface, it seems reasonable, but after a few minutes of checking the data, it becomes clear that the facts are different.

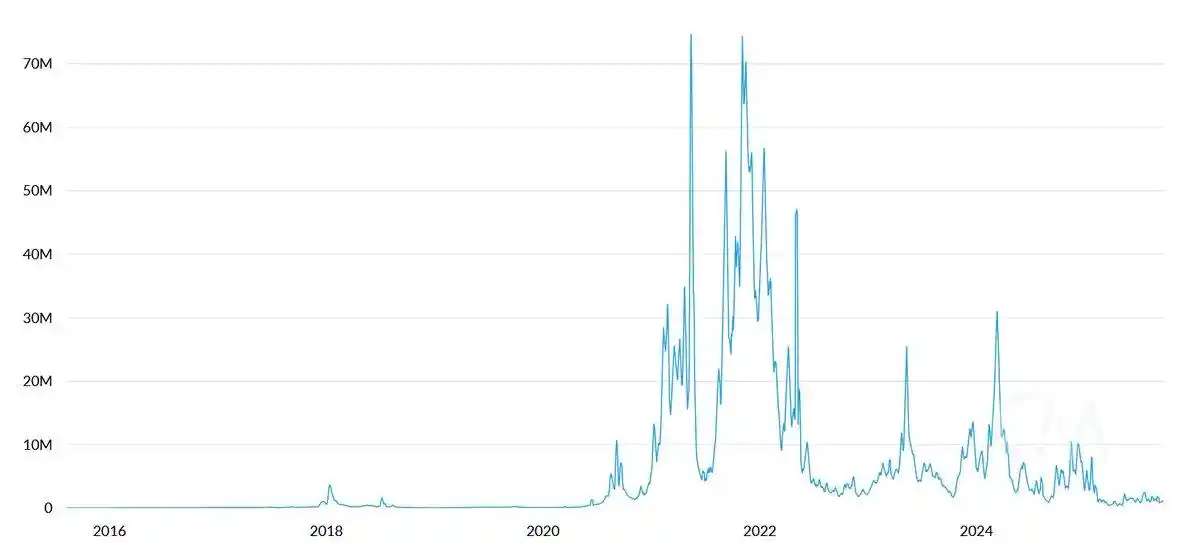

Since 2020, the value of tokenized assets and the transaction volume of stablecoins have increased by 100-1000 times. However, Tom Lee fundamentally misunderstands Ethereum's value accumulation mechanism—he makes people believe that network transaction fees will rise proportionally, but in reality, Ethereum's transaction fee revenue has remained at 2020 levels.

The reasons for this result are as follows:

· Ethereum network improves transaction efficiency through upgrades;

· Stablecoin and asset tokenization activities flow to other blockchains;

· The transaction fees generated from tokenizing illiquid assets are negligible—tokenized value and ETH revenue are not proportional. People may tokenize a 100 million USD bond, but if it is traded once every two years, how much transaction fee can it bring to ETH? Possibly only 0.1 USD. The transaction fee generated by a single USDT exchange is far higher than this.

You can tokenize assets worth tens of billions of dollars, but if these assets are not frequently traded, they may only add 100,000 USD in value to ETH.

Will blockchain transaction volume and fees increase? Yes.

However, most of the fees will be captured by other blockchains with stronger business development teams. As traditional financial transactions move to blockchain, other projects have already seen this opportunity and are actively occupying the market. Solana, Arbitrum, and Tempo have achieved some early victories, and even Tether is supporting two new stablecoin blockchains (Plasma and Stable), hoping to shift USDT transaction volume to their own chains.

Two, The "Digital Oil" Analogy

Oil is essentially a commodity. After adjusting for inflation, the real oil price has remained within the same range for a century, occasionally fluctuating and returning to its original level.

I partially agree with Tom Lee's point that ETH can be considered a commodity, but this does not mean it is bullish. I'm not sure what Tom Lee is trying to express here.

Three, Institutions Will Purchase and Stake ETH, Providing Network Security and Working Capital

Have large banks and other financial institutions already bought ETH into their balance sheets? No.

Have they announced plans to purchase ETH? No either.

Will banks hoard gasoline barrels because they keep paying energy costs? No, the cost is not significant. They only pay when needed.

Will banks buy stocks of the asset custodians they use? No.

Four, ETH Will Be Equivalent to the Total Value of All Financial Infrastructure Companies

I am really speechless. This is another fundamental misunderstanding of value accumulation, pure fantasy, I don't even feel like commenting on it.

Five, Technical Analysis

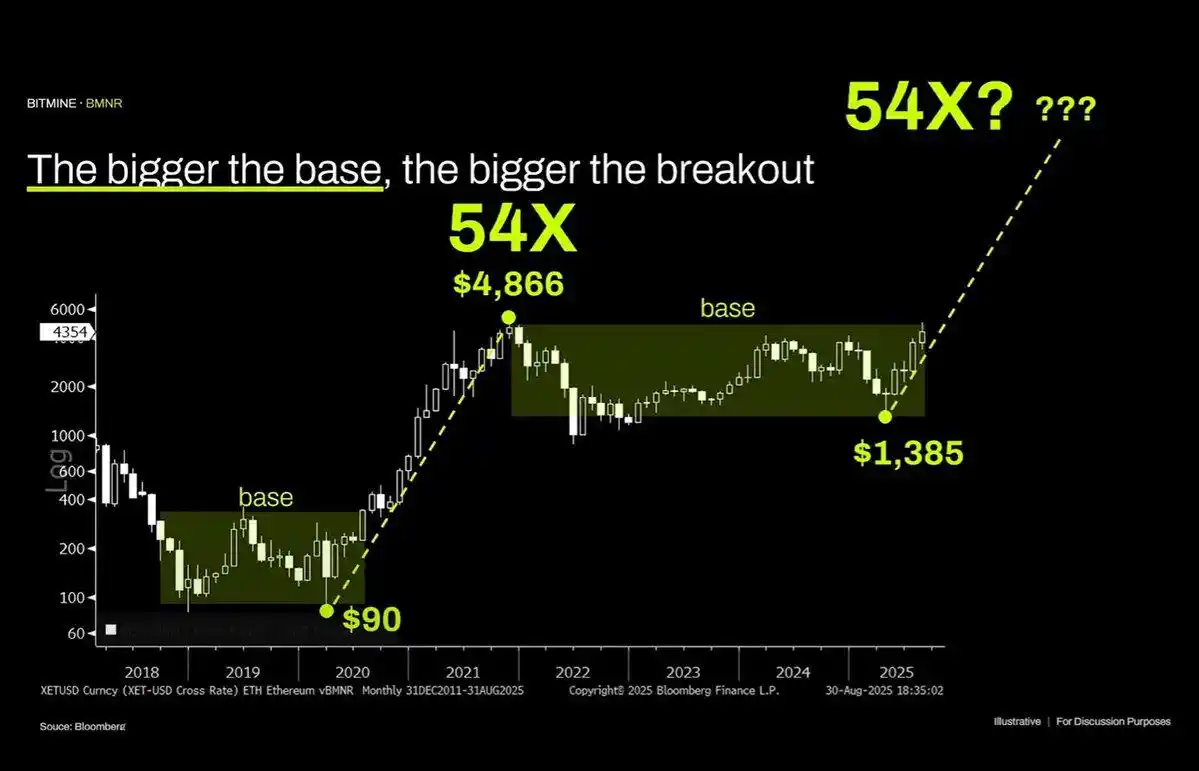

I personally really like technical analysis and believe that when it is objectively viewed, technical analysis can indeed provide a lot of valuable information. Unfortunately, Tom Lee seems to be drawing lines arbitrarily to support his bias.

Objectively reviewing this chart, the most obvious feature is that ETH is in a prolonged range trading pattern that has lasted for years — this is no different from the wide-range fluctuations of oil prices over the past three decades — just a range-bound movement, and recently even failed to break through the resistance after reaching the top of the range. From a technical perspective, ETH shows a bearish signal, and it cannot be ruled out that it may continue to oscillate in the range of 1,000 - 4,800 USD in the future.

A particular asset experiencing a parabolic rise in the past does not mean that this trend will continue indefinitely.

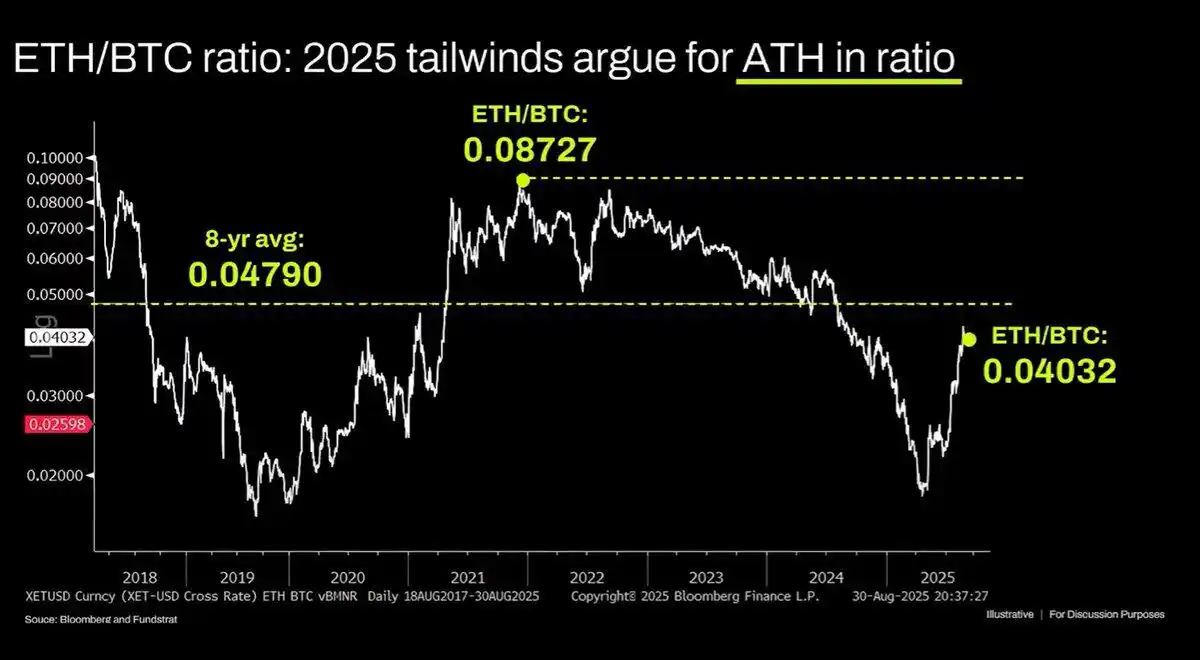

The long-term ETH/BTC chart is also misinterpreted. Although it is indeed in a multi-year range, it has been constrained by a downward trend for the past three years, and the recent rebound has only reached the long-term support level. This downward trend stems from the narrative of Ethereum being saturated, and the fundamentals cannot support valuation growth. These fundamental factors have not changed substantially to date.

The valuation of Ethereum is essentially a product of financial ignorance. Objectively speaking, this cognitive bias can indeed support a considerable market cap (see XRP), but its support is not infinite. Macroeconomic liquidity temporarily maintains the level of ETH's market cap, but unless there is a major structural change, it is likely to face continued poor performance.

Disclaimer: Contains third-party opinions, does not constitute financial advice

Alpha Research

Alpha New Token Research Report, Binance Alpha Operation Suggestions

Popular Airdrop Tutorial

Selected potential airdrop opportunities to gain big with small investments

Crypto-linked Stocks

Crypto-stock linkage, real-time market quotes and in-depth analysis

Market Analysis

BTC/ETH, Major Cryptocurrencies, and Hot Altcoins Price Trends

Regulatory Watch

American Crypto Act – timely interpretations of policies worldwide

Frontier Insights

Spotlight on Frontier, trending projects, and breaking events

Crypto Weekly

Tracking on-chain movements of the smart money and institutions

ChainThink App

WeChat Official Account

WeChat Customer Service