The next milestone of RWA, Nasdaq is really considering tokenized stocks

2025-09-10 10:00

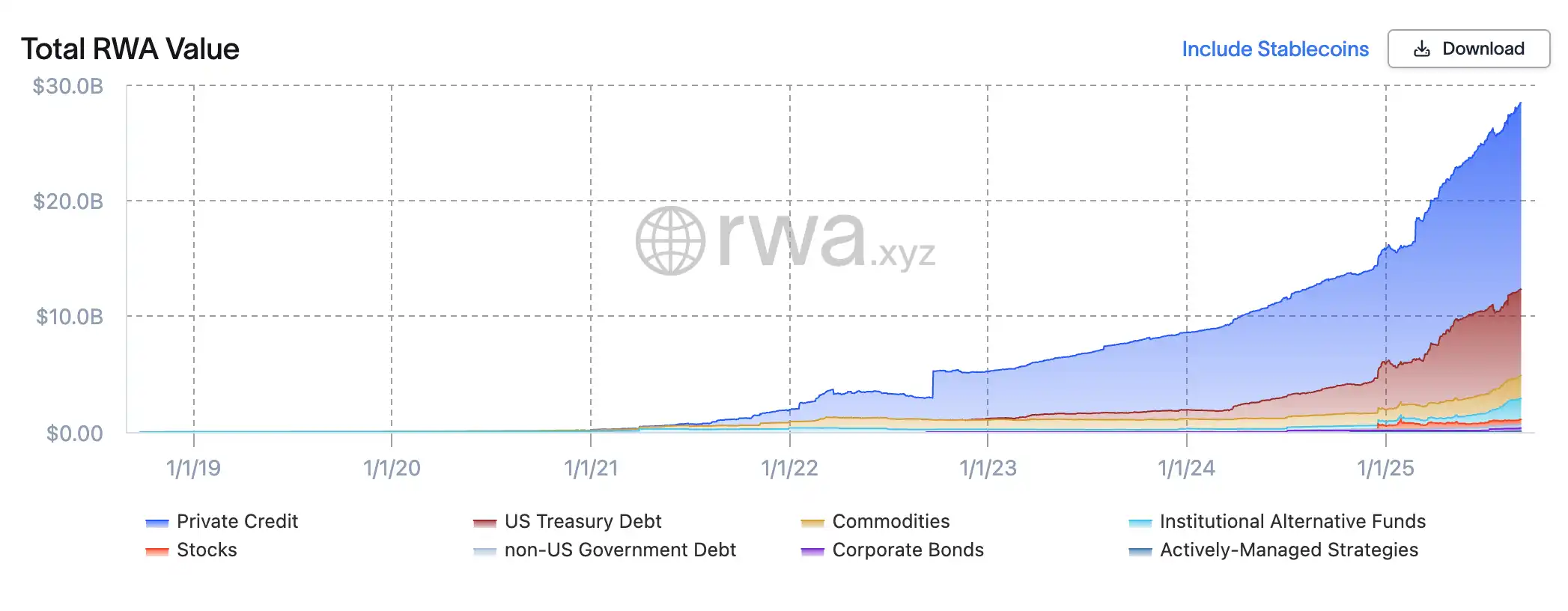

In less than two years, the tokenized securities market has experienced nearly "explosive" growth. According to RWA.xyz data, the total market value of RWA (Real World Assets) tokenization has now exceeded $2.8 billion, with the on-chain stock volume reaching $420 million—less than $5 million at the beginning of 2024, a more than 80-fold increase in just two years.

The surge is driven by the collective entry and accelerated layout of enterprises: Robinhood launched a tokenized private equity product covering hot targets such as SpaceX and OpenAI; Kraken's XStocks has already listed over 50 U.S. stocks and ETFs in tokenized form; Ondo's Wall Street 2.0 has launched over 100 U.S. stocks and ETFs on Ethereum; Galaxy Digital was the first to move its Nasdaq-listed stocks onto a public blockchain; SBI Holdings partnered with Startale to establish an on-chain trading platform in Japan. Whether crypto-native companies or traditional financial giants, all are vying for the first-mover advantage in this emerging tokenized stock market.

This is not only a race between crypto and traditional finance, but also seen as a potential "revolution" against the traditional exchange model. On September 8, the world's second-largest exchange, Nasdaq, chose to actively respond, submitting an application to the U.S. Securities and Exchange Commission (SEC), officially embracing tokenized stocks, attempting to push this transformation from the "peripheral experiment" to the core stage of Wall Street.

New Packaging Under the Old System: The Operational Logic of Tokenized Stocks

Tokenized stocks are not a new asset that appears out of nowhere, but rather a new "packaging form" of traditional equity. Its key lies in how to integrate the accounting and settlement capabilities of blockchain into the existing financial infrastructure. In Nasdaq's rule proposal submitted to the SEC, this logic is clearly articulated: In the future, investors can choose the "tokenized settlement" option when placing orders in the system, and the trade matching will still be completed in the same order book, without obtaining any additional priority due to tokenization. The real change occurs after the transaction—Nasdaq will send the settlement instructions to the Depository Trust Company (DTC), which will transfer the traditional stocks into a dedicated account and mint equivalent tokens on the chain, then distribute them to the brokers' wallets. This way, tokenized stocks maintain complete consistency with traditional stocks in the trading phase, only introducing a chain-based mapping at the settlement layer.

This design means that tokenized stocks are not outside the national market system (NMS), but are incorporated into the existing regulatory and transparency framework: Transactions are still recorded in the National Best Bid and Offer (NBBO), ownership and voting rights are identical to traditional stocks, and transaction monitoring is jointly executed by Nasdaq and FINRA. In other words, tokenization here is not "starting from scratch," but rather an upgrade of the underlying infrastructure. "We are not trying to replace the existing system, but to provide the market with another more efficient and transparent technological option," said Chuck Mack, Senior Vice President of Nasdaq North America, in an interview. "Tokenized securities are simply the same asset expressed in a new form on the blockchain." It can utilize the existing market structure and clearing system, while allowing blockchain to become the next generation of custody and settlement tools.

From a more macro perspective, the appeal of tokenization lies in its ability to touch several core pain points of capital markets. First, settlement efficiency—under the current system, stock transactions usually take T+1 or longer to settle, while on-chain settlements can almost achieve real-time clearing, reducing counterparty risk. Second, trading time and accessibility—traditional exchanges follow opening and closing hours, and cross-border investments require multiple intermediaries, while tokenized stocks can theoretically trade 24/7 and are easier to access overseas investors through blockchain wallets. Lastly, the programmability of assets, which means that proxy voting, dividend distribution, and even corporate governance could be automated and transparently implemented with the support of smart contracts.

Looking ahead, Nasdaq has positioned tokenization as the next iteration of capital market infrastructure. According to the plan, once DTC completes the upgrade, on-chain settlement functionality is expected to be available by the third quarter of 2026, at which point tokenized stocks will coexist with traditional stocks within the regulated U.S. market. Nasdaq explicitly rejects advancing through exemptions or circumvention, which not only upholds investor protection principles but also avoids the risk of liquidity fragmentation.

Divergent Paths Among Different Players

xStocks: Compliance Custody + DeFi Composability

xStocks is driven by Backed Finance, leveraging DLT laws in Switzerland and Liechtenstein to establish an SPV holding real stocks, then minting tokens on a public blockchain at a 1:1 ratio. Tokens legally represent secured preferred claims, backed by custodians and real-time reserve proofs. The issuance and trading ends are separated, and tokens can circulate on centralized exchanges like Kraken and Bybit, as well as integrate with DeFi protocols like Jupiter and Kamino on Solana. The highlight of this model is openness and transparency, truly possessing cross-market and cross-protocol composability, but the drawback is limited liquidity, with market size still insufficient to rival off-chain alternatives.

Robinhood: Closed-Loop On-Chain Experiment by Licensed Brokers

Robinhood, however, takes a completely different approach. It relies on its Lithuanian subsidiary's MiFID II license to procure and custody U.S. stocks, ETFs, and private equity under a compliant framework, then mint corresponding tokens on the Arbitrum chain. All token transactions are completed within the Robinhood app, with tokens and real shares being mapped in real time, ensuring "on-chain quantity = custody position." The advantages of this model include regulatory control and consistent user experience, even enabling fractional dividend distribution and on-chain settlement, but tokens are almost non-transferable, lacking open liquidity. Robinhood views tokenization as a tool for expanding its financial footprint, rather than merely a market innovation.

Galaxy: "Native Tokens" of Listed Companies Going On-Chain

Different from the previous two, Galaxy Digital chose to directly move its Nasdaq-listed stocks onto the blockchain. It partners with Superstate, a SEC-registered transfer agent, allowing shareholders to convert GLXY common shares 1:1 into tokenized shares on Solana via a compliant process. Unlike "mirror tokens" or "synthetic contracts," these tokens are legally real shares, enjoying full voting and dividend rights. Galaxy's attempt was the first to achieve "token and stock rights equality," laying the foundation for a true on-chain equity market. However, its liquidity is still in the early stages, currently supporting only peer-to-peer trading among registered users, and it still needs further regulatory relaxation to reach a full secondary market.

Ondo: Building Wall Street 2.0

Ondo Finance, founded by former Goldman Sachs executives, follows a path of "institutional-grade packaging + open distribution." The latest launched Ondo Global Markets platform has tokenized over 100 U.S. stocks and ETFs onto Ethereum, providing legal on-chain investment access for non-U.S. investors. The model is: Ondo purchases and custody real stocks through licensed brokers, then mints tokens on-chain at a 1:1 ratio, ensuring each token has full economic rights, including dividends and corporate actions. Ondo's highlights are scalability and openness—it not only provides daily reserve proofs, bankruptcy isolation, and third-party custody, but also supports cross-chain interoperability and DeFi composition. Users can invest in star stocks like Apple and Tesla, or use tokens as collateral for lending and automated strategies. Ondo turns tokenization into a "global financial supermarket," aiming to combine Wall Street's liquidity with blockchain's transparency to build a true Wall Street 2.0.

Embrace or Risk? The On-Chain Test for Wall Street

Nasdaq's formal submission of an application for tokenized stock trading to the SEC is seen as a "core attempt" by Wall Street in the digital transformation process. The core of this proposal is: tokenized stocks should have the same rights and protections as their underlying securities, trade matching still occurs in the existing order book, and settlement is handled by DTC through the on-chain minting of equivalent tokens. This means that tokenization is no longer an edge experiment, but may become part of the institutional infrastructure of the U.S. capital market. Compared to Robinhood or xStocks, which remain in price mapping and contract certificate models, Nasdaq's approach is more thorough—it becomes the first tokenization solution that fully migrates all shareholder rights (voting rights, dividend rights, governance rights) onto the blockchain. This means that investors are not receiving a "shadow" of the stock, but a fully rights-bearing digital stock entity.

Nasdaq CEO Tal Cohen stated, "Blockchain technology offers unprecedented possibilities for shortening settlement cycles, modernizing proxy voting, and automating corporate actions." In other words, Nasdaq is not trying to overturn the old order, but upgrading the market's underlying architecture with minimal institutional friction, ensuring that the core principles of investor protection and market transparency are not shaken. For regulators, this stance sends a positive signal—rather than letting tokenization grow wildly abroad or in gray areas, it is better to directly incorporate it into a regulated framework.

However, negative voices also exist. JPMorgan pointed out in a report that tokenization of bonds and stocks "has not yet achieved significant adoption outside of crypto-native companies," reminding the market not to overestimate short-term prospects. Citadel Securities warned that if regulators rush forward without clear rules, it could instead trigger market risks. Globally, the World Federation of Exchanges (WFE) also wrote to regulators, expressing concerns that tokenized stocks "mimic" real equity but may lack shareholder rights and safeguards, urging stronger legal applicability and custody frameworks. These doubts indicate that although the potential of tokenization is huge, institutional implementation still requires a long period of adjustment.

Summary

Nasdaq's proposal is not just a technical adjustment, but a "trial" of institutional changes. If the SEC ultimately approves, this will mark the first time that blockchain technology occupies a central position in the mainstream U.S. stock market, and may lay the foundation for future 24/7 trading, instant settlement, and smart contract governance. But before all of this truly happens, the market still needs to observe: Can regulators provide a clear framework, can investors trust this new model, and can tokenization really bring value beyond the traditional market?

Disclaimer: Contains third-party opinions, does not constitute financial advice

Alpha Research

Alpha New Token Research Report, Binance Alpha Operation Suggestions

Popular Airdrop Tutorial

Selected potential airdrop opportunities to gain big with small investments

Crypto-linked Stocks

Crypto-stock linkage, real-time market quotes and in-depth analysis

Market Analysis

BTC/ETH, Major Cryptocurrencies, and Hot Altcoins Price Trends

Regulatory Watch

American Crypto Act – timely interpretations of policies worldwide

Frontier Insights

Spotlight on Frontier, trending projects, and breaking events

Crypto Weekly

Tracking on-chain movements of the smart money and institutions

ChainThink App

WeChat Official Account

WeChat Customer Service