Million-Dollar Promotion Scandal: Exposing the Behind-the-Scenes of KOLs Making Money Overseas

2025-09-03 16:48

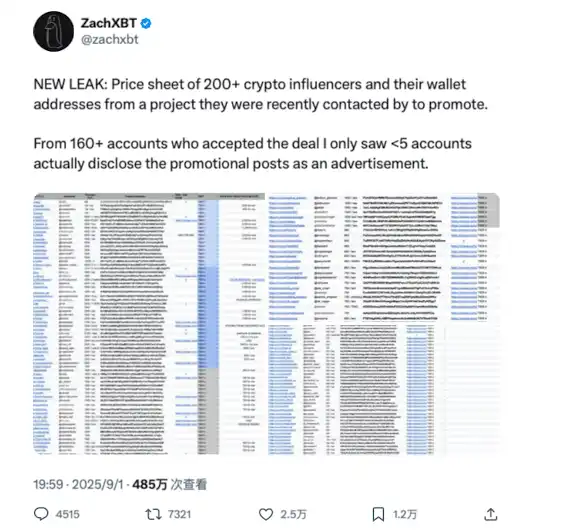

On September 1st, when the market's attention and liquidity were focused on Trump's $WLFI, renowned on-chain detective @ZachXBT once again started to leak information.

He revealed a list of overseas KOLs who had paid for promotions, recording multiple English-speaking KOLs promoting crypto projects on X platform for payment, involving numerous accounts with total payment amounts exceeding one million dollars; the price per tweet varied from 1,500 to 60,000 dollars depending on the KOL's status.

ZachXBT pointed out that among the KOLs on this list, fewer than five accounts marked their promotional posts as "ads", which means that most KOLs' public posts on social media are not clear whether they are paid articles or purely spontaneous sharing.

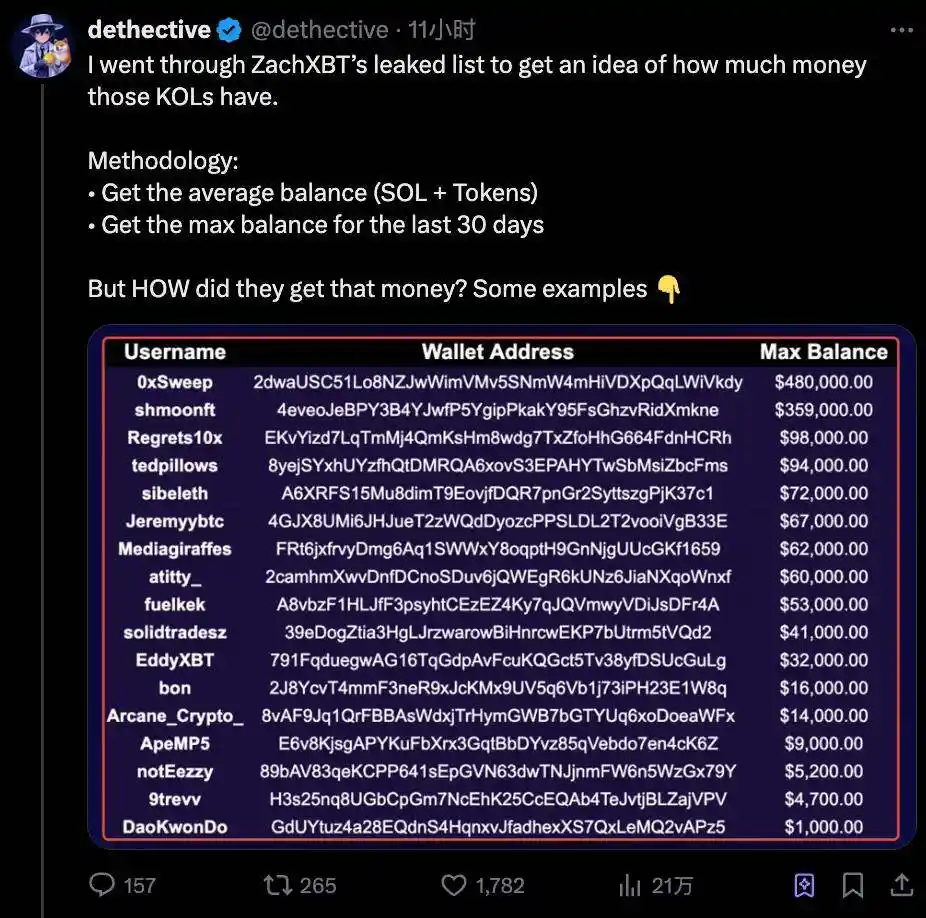

Subsequently, another small detective @dethective further analyzed and organized this original table, discovering more elaborate methods these overseas KOLs used in paid promotions.

Multiple accounts, earning money from project parties twice

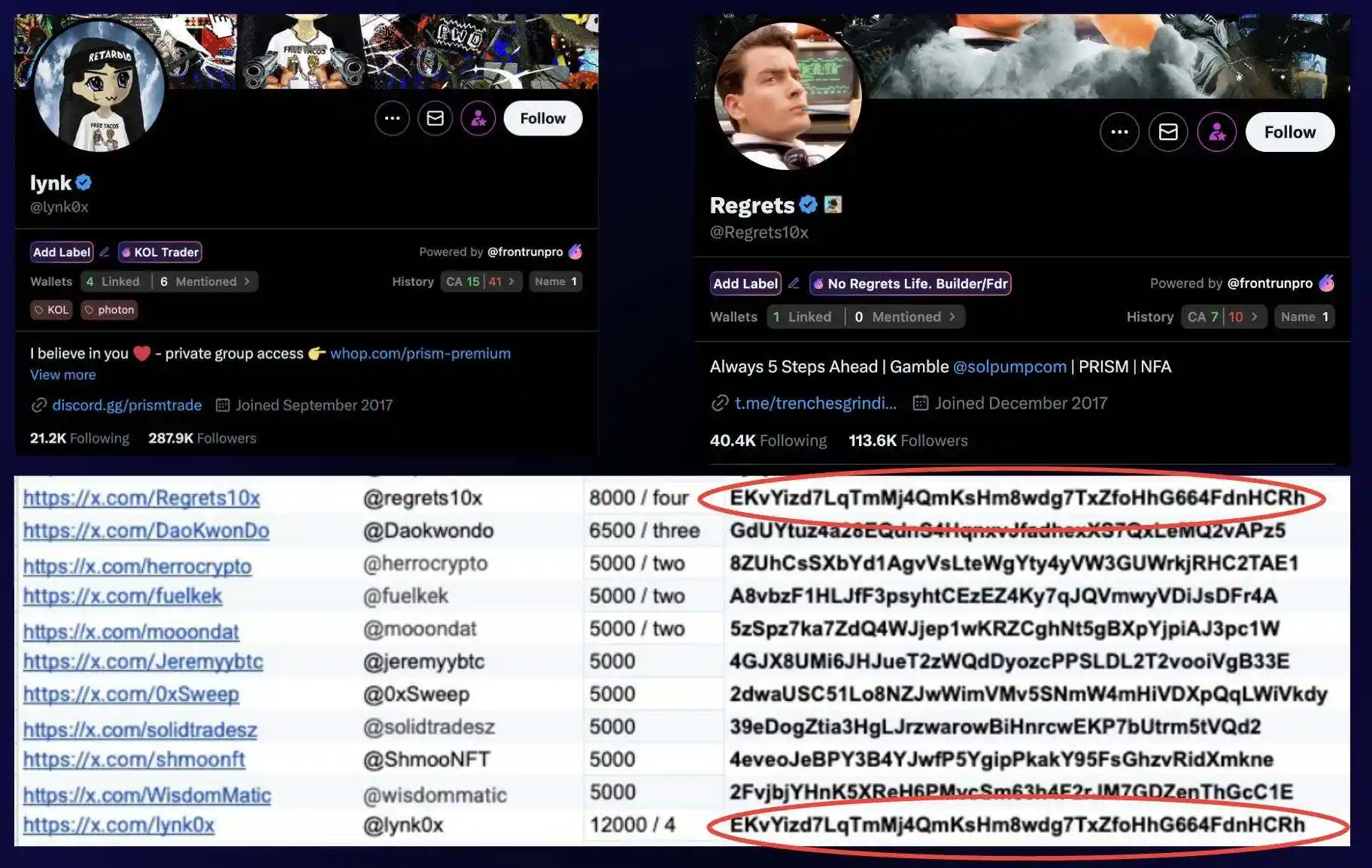

In @dethective's analysis, the first issue that stood out was that some wallet addresses appeared repeatedly in the list.

This means that the same wallet might correspond to multiple KOL accounts, yet received promotion fees twice or even multiple times for the same project.

Taking the accounts @Regrets 10 x and @lynk 0 x as examples. The list shows that the former earned 8,000 dollars for four posts, while the latter earned 12,000 dollars for the same number of posts, which may be due to different follower sizes between the two accounts.

But their wallet addresses are exactly the same:

EKvYizd 7 LqTmMj 4 QqmKsHm 8 wdg 7 TXzFoHHg 664 FdnhCRh

After cross-referencing, the blogger @dethective found that not only these two accounts, but there are about 10 similar repeated wallet addresses in the entire list.

A possible reason is that some overseas KOLs, in order to expand their influence, use small accounts or affiliated accounts to participate in promotions without changing the wallet address, thus exposing traces;

But thinking deeper, regardless of laziness or oversight, not changing the wallet address actually reflects the situation of group promotion, that is, multiple accounts posting simultaneously for the same project can more easily occupy social media timelines and attention, thereby triggering FOMO emotions among fans.

Of course, the two KOL accounts that were exposed did not remain idle.

@lynk 0 x denied receiving money in the comment section, saying that @Regrets 10 x was just a friend, and the shared wallet was just a coincidence. However, @dethective quickly released evidence:

The wallet mentioned above received 60,000 dollars from a project called "Boop", and to claim the airdrop, it was necessary to bind an X account. This indirectly proves the relationship between the account and the wallet, making it hard to deny.

@Regrets 10 x's response was more casual, he did not directly answer the accusation, but said that as long as the paid promotion was disclosed when posting, it was fine;

It is acceptable to receive ads for meals, and proper disclosure helps others understand the motivation and interest relationships behind the posts. Some more professional KOLs often add a note like "interest related" or "interest unrelated" at the end of a post.

But the problem is, if two accounts belong to the same person, the same promotional content, one account publicly reminds that it is an advertisement, while the other remains silent, this is more like a strategy for building a persona matrix.

And even worse, some have turned the practice of mass account promotion into an industry chain.

Previously, the research institution DFRLab published a study titled "Analyzing Cryptocurrency Scams on Twitter," in which it mentioned that certain gray industries could control dozens of accounts, posting nearly 300 tweets daily through batch account cultivation, automated forwarding and replying, and cross-endorsement to create false popularity.

Operators usually purchase old accounts or mass register new ones, change nicknames and avatars, and become a brand new KOL, then use scripts to copy the same recommendation messages into the comments of high-traffic tweets to "attract fans".

"To The Moon"

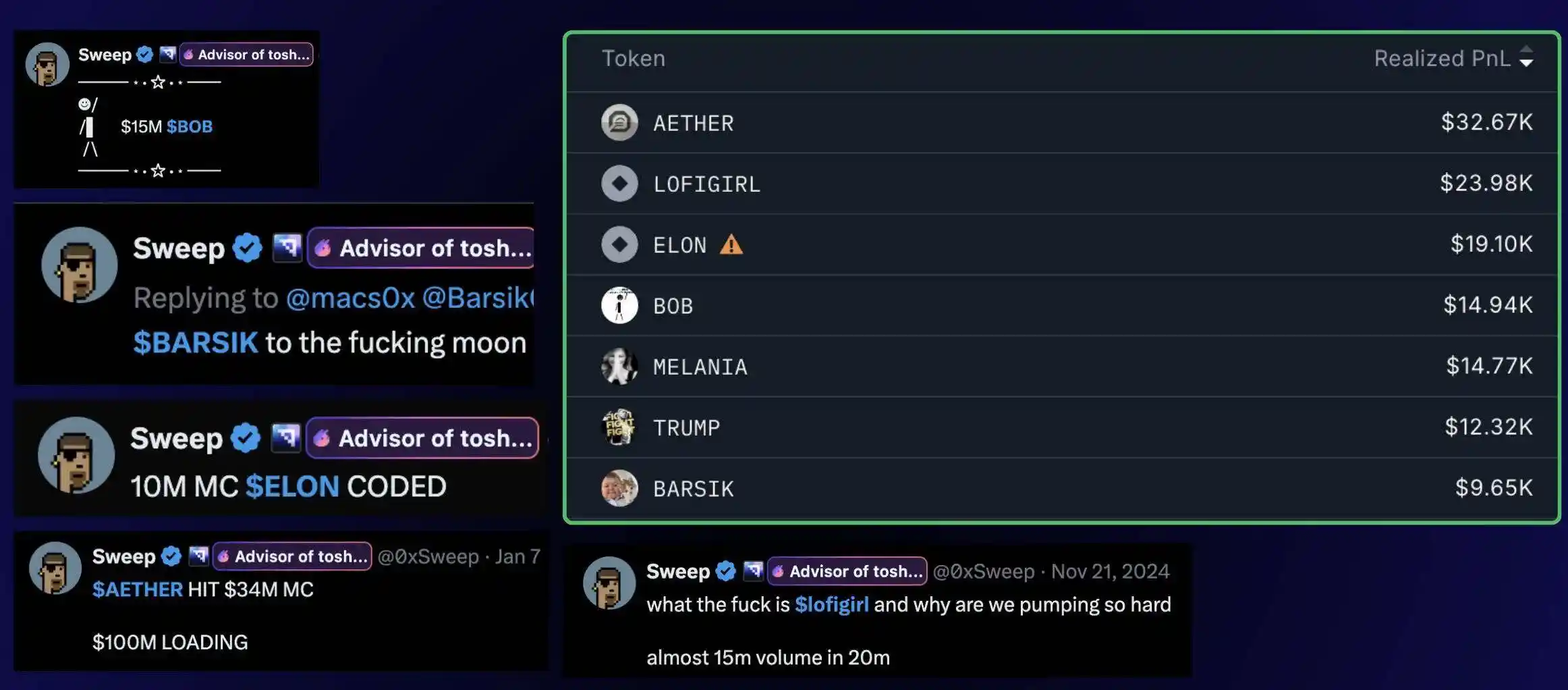

After the list was exposed, another point worth noting was that the profit sources of these overseas KOLs' wallets often highly overlapped with the tokens they promoted.

In other words, they were not randomly posting "experiences", but rather received tasks first, and after posting, they also traded themselves.

For example, the account @0 xSweep, in @dethective's wallet analysis, his main profit source was several tokens on BullX exchange: $AETHER, $BOB, $BARSIK, etc.

But the background is that these tokens had paid promotion records on ZachXBT's list, and @0 xSweep's X posts repeatedly mentioned them, believing that the tokens had great potential and were capable of "to the moon".

However, his wallet records show that these profitable transactions occurred right before and after the promotion, which could very likely mean that the project party paid him to post, and after the post, the token's popularity increased, and he then manipulated the transaction to show that he was trading.

This means that if a certain account keeps telling you about the experience of trading tokens, he may not earn income from trading and market judgments.

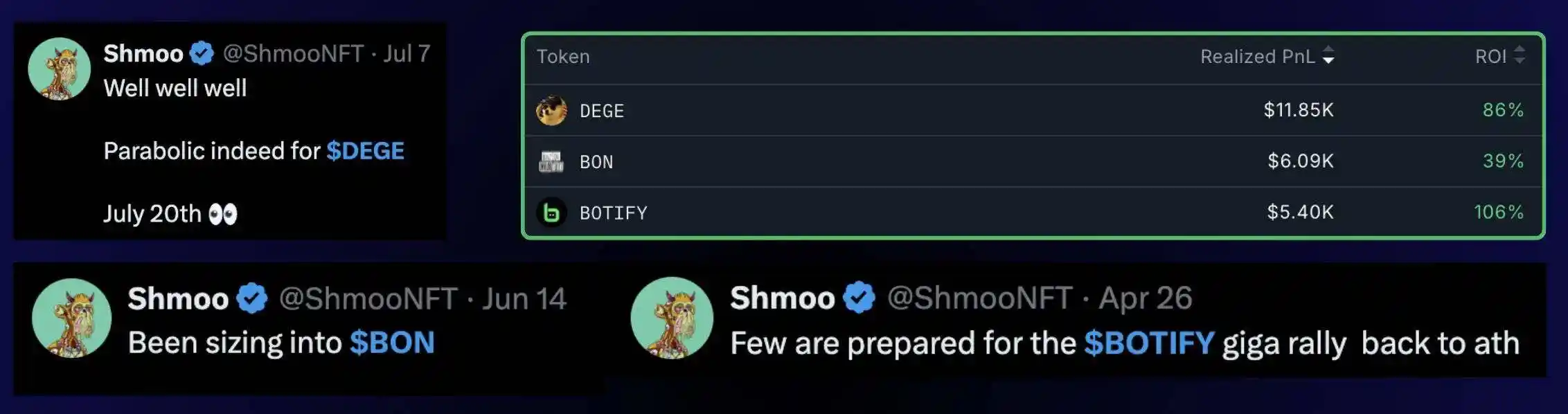

Similar situations exist for @ShmooNFT. His Telegram channel promotes around 10 tokens daily, which initially seems like enthusiastic sharing.

But wallet tracking shows that his few profitable transactions such as $DEGE, $BON, $BOTIFY were all promoted on X, and were also listed in ZachXBT's previous leaks.

The core issue of this model is that the KOL's "advice" has private interests: the promotional posts are not marked as ads, and the followers think it's a genuine recommendation, but in reality, it's a paid collaboration.

If the token indeed has potential, it can be a win-win, but if the "call to action" for a dog coin results in zero value, the KOL's own reputation and influence will also decline.

The sophistication of this tactic lies in the fact that these overseas KOLs may earn three types of revenue.

First, by receiving free tokens through airdrops, then charging the project party for promotion, and finally selling the airdropped tokens after driving up the price through calls to action.

And common advanced tactics: by showcasing transactions and profits to build a "trading god" image, then establishing paid groups to collect "group entry fees".

There is demand, so there is a market

At the end of the analysis post, demethective also asked a thought-provoking question:

Why do some project parties still choose these accounts, even though they know some of the habits and tactics of overseas KOLs?

The answer is that where there is demand, there is a market.

Some projects prefer this audience that wants to get rich quickly, and the channels and groups operated by some of the accounts mentioned in the previous leaks perfectly attract this audience: those who lack independent research capabilities, are more inclined to trust calls to action and luck, and try to find an undervalued golden dog.

Such KOL accounts are often defined as "more commercially valuable" in a market where bad coins drive out good ones.

Leakage itself involves interest disputes and is easy to be ungrateful and cause trouble; but recommending tokens, if even one or two succeed, can easily be spread as a trading master.

Original title: "A Showcase of Foreign KOLs' Grass-Meat Slaughtering Techniques: Clustering, Creating Momentum, and Concealment"

Original author: Umbrella, David, Deep Tide TechFlow

Disclaimer: Contains third-party opinions, does not constitute financial advice

Alpha Research

Alpha New Token Research Report, Binance Alpha Operation Suggestions

Popular Airdrop Tutorial

Selected potential airdrop opportunities to gain big with small investments

Crypto-linked Stocks

Crypto-stock linkage, real-time market quotes and in-depth analysis

Market Analysis

BTC/ETH, Major Cryptocurrencies, and Hot Altcoins Price Trends

Regulatory Watch

American Crypto Act – timely interpretations of policies worldwide

Frontier Insights

Spotlight on Frontier, trending projects, and breaking events

Crypto Weekly

Tracking on-chain movements of the smart money and institutions

ChainThink App

WeChat Official Account

WeChat Customer Service