The Sleeping Giant Has Awakened: The Second Surge of DeFi Veterans

2025-08-13 17:21

DeFi market is experiencing a long-awaited resurgence of veteran projects.

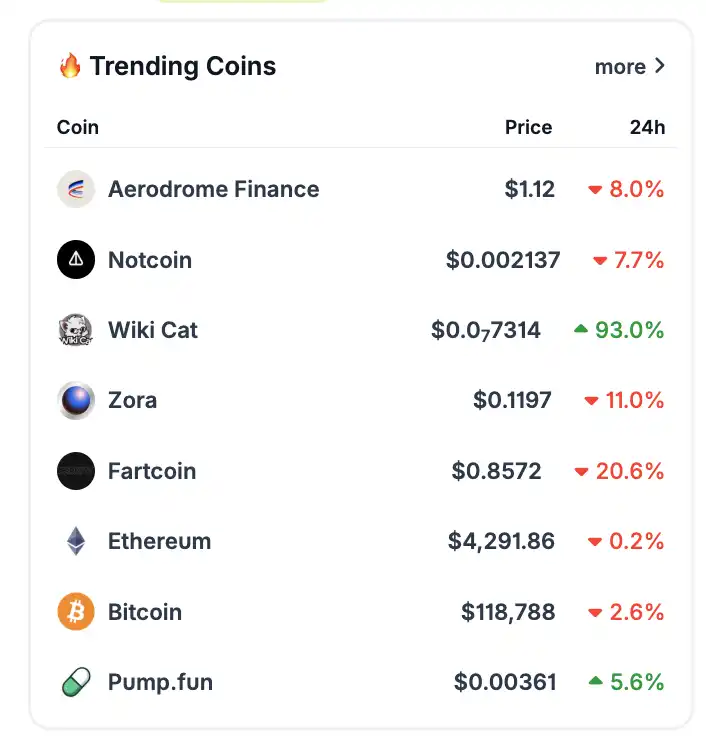

As of now, the total value locked (TVL) in the DeFi market has climbed to $197 billion, just one step away from the historical high of $206 billion. More importantly, the leading force behind this rebound is not new projects that have just emerged, but a batch of "veterans" who once shone brightly during the DeFi Summer.

From the earliest speculative demand to the current "renewal of old trees." The collective growth of the DeFi market is driven by institutional capital accelerating its entry (RWA, compliant lending, 401k crypto investment), a recovery in retail demand for on-chain yields during the bull market, and new use cases brought about by technological iteration. The return of veterans is both a reflection of market confidence and the prelude to a new round of DeFi competition.

BlockBeats has compiled the main reasons for the recent sharp rise in the price and TVL of these DeFi "veteran players": Aave, Uniswap, Euler, Pendle, Fluid, Spark.

AERO: Violent rebound under Coinbase's support

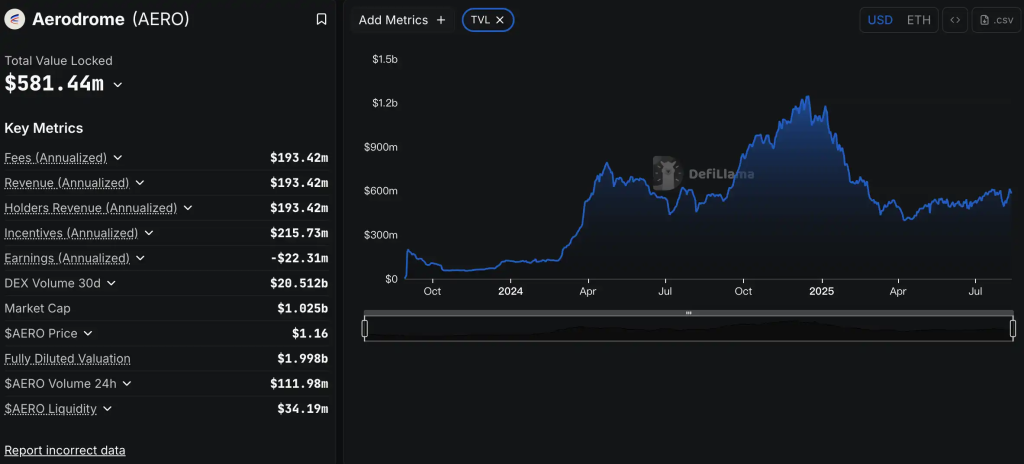

Aerodrome Finance (AERO) is a decentralized exchange (DEX) launched in 2023 and deployed on the Base chain, operating with an automated market maker (AMM) model, and featuring vote-lock governance and strong liquidity incentive mechanisms. It adopts a highly community-friendly design, with an anonymous team that has not accepted venture capital or private sales, maximizing the alignment of interests with users. Within 72 hours of its launch, it achieved a financial TVL exceeding $200 million, and later, in 2024, its total trading volume exceeded $1 billion, with Slipstream functionality contributing 85% of it. As of June 2025, the cumulative trading volume of AERO has surpassed $100 billion, firmly securing its position as a core part of the Base DeFi ecosystem.

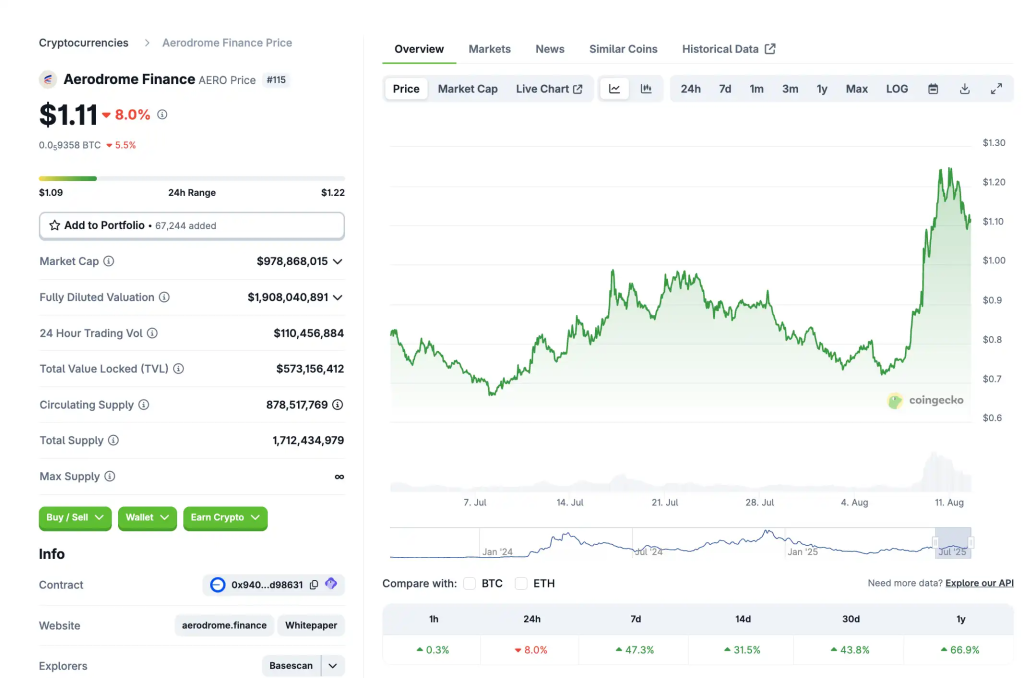

Recently, AERO has shown a strong upward trend: On August 9, it surged due to the news of Coinbase's native DEX feature launch, reaching as high as $1.23, with a 7-day increase of approximately 47%. Its current market cap is about $978 million, making it a popular project coin recently.

In addition to Aerodrome being one of the first supported assets when Coinbase integrated Base native assets into its App's DEX trading function, the rise of AERO may also be attributed to the launch of the "Pool Launcher" tool, which allows projects to create liquidity pools and earn related transaction fees, attracting more Base-native projects to join the ecosystem.

Currently, Aerodrome's TVL is approximately $580 million, almost entirely from the Base chain. The 24-hour DEX trading volume is nearly $950 million, and the total trading volume over the past 30 days reached $20.5 billion. In terms of revenue and investment, Aerodrome's annualized fee income is expected to be around $193 million, with revenue over the past 30 days at approximately $15.85 million, and cumulative reward incentive expenditures reaching $706 million, indicating a strong liquidity incentive orientation.

Currently, Aerodrome has built a leading trading and incentive mechanism on the Base chain, becoming a DeFi liquidity hub. Coinbase integration has opened a window to a broader user base, acting as a catalyst for concentrated capital and liquidity surges.

Although the upward trend is evident, high incentive spending and overheated technical indicators suggest caution regarding short-term adjustments. In the medium to long term, attention should be paid to whether the ecosystem expansion continues, whether partner projects are implemented, and whether Coinbase will continue to expand its support range, which will determine whether it can return to its historical high ($2.32) or continue to break through.

Fluid Flip Uniswap's ambition

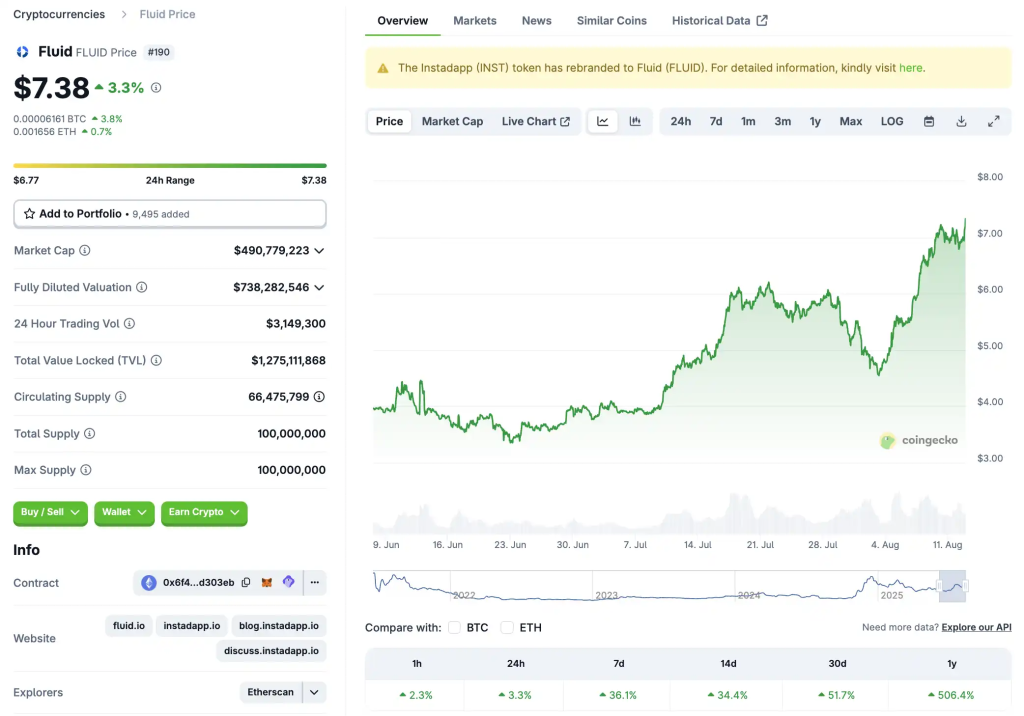

Fluid is a DeFi protocol integrating DEX (decentralized exchange), lending, and Vault systems, achieving high capital efficiency and liquidity reuse through its innovative Liquidity Layer. Launched on Instadapp and re-launched in 2023, Fluid allows assets to freely switch usage within the liquidity layer without multiple lockups, significantly reducing fragmentation costs and increasing returns. Its Smart Debt and Smart Collateral models offer better capital efficiency for liquidity providers and debtors.

In recent DeFi markets, Fluid has become one of the focal points: On August 4, Fluid's daily on-chain trading volume once exceeded Uniswap, reaching approximately $1.5 billion, driving the price of $FLUID to surge 14.4% on the same day. As of now, Fluid has risen to $7.38, with a 7-day increase of 36.1% and a 30-day increase of 51%.

The factors behind Fluid's rise may include the following four aspects:

1. The liquidity layer architecture breaks fragmentation

Fluid is being launched on chains such as Arbitrum and Solana, introducing a lighter Lite version, while supporting DEX v2 upgrades, which helps further increase yields and user coverage. Moreover, Fluid's Liquidity Layer enables shared liquidity, allowing assets to meet multiple usage needs with a single deposit, which is the core driver of its rapid capital and trading absorption.

2. Trading share rapidly rises

Short-term Fluid surpasses Uniswap, capturing over half of the stablecoin trading market, directly strengthening its ecological and emotional dual-wheel drive.

3. Traders' confidence rebounds

DEX daily trading volume hits a new historical high, token prices surge in the short term, indicating increased market recognition of Fluid's model, and the efficiency of liquidity allocation is affirmed.

4. Long-term positive expectations from the buyback mechanism

The official has clearly stated that a buyback will be initiated when the annualized revenue reaches $10 million, providing medium- to long-term support for token value, attracting investors to position themselves at low prices.

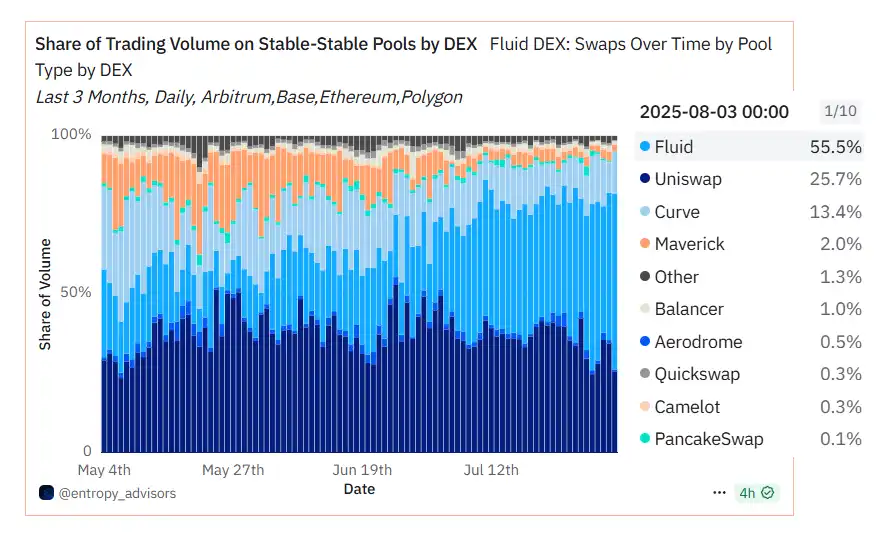

The platform's cumulative trading volume has surpassed $7.9–$8 billion, with a monthly TVL growth rate of approximately 27%, totaling about $838 million, showing a strong capital growth trend. Since 2025, Fluid's deposits have increased by nearly 40%, exceeding $1.4 billion, and it has launched multi-chain strategies (such as Arbitrum, Solana) and plans for DEX Lite. As of August 3, Fluid's stablecoin swap market share on Ethereum, Base, Arbitrum, and Polygon reached 55.5%, far exceeding Uniswap (25.7%) and Curve (13.4%).

Overall, Fluid has become a "new force" in DeFi: Through its unique Liquidity Layer, strong trading data, and multi-chain expansion strategy, it has quickly returned to the center stage, setting a new benchmark for stablecoin trading in DeFi. Its short-term performance is impressive, but several risk points still need attention: Whether FLUID will experience a short-term adjustment remains to be observed; the implementation of the ecosystem and user stickiness, whether subsequent projects can truly build on Fluid's liquidity layer, is the key to sustained momentum. If the DEX v2 and Lite versions are successfully implemented and drive revenue to reach key milestones, it not only triggers the buyback mechanism but could also further enhance user stickiness and market valuation, helping Fluid become a new benchmark for stablecoin trading.

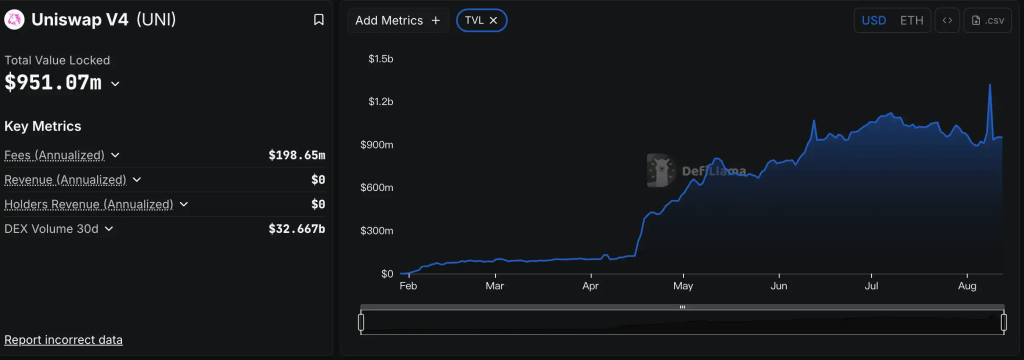

Uniswap v4 TVL again breaks $10 billion

Uniswap is a veteran in the DeFi world. Its v4 version was officially launched in early 2025, covering 12 chains including Ethereum, Arbitrum, Base, Polygon, BNB Chain, and Unichain. It introduced the "Hooks" feature, enabling liquidity pools to have dynamic fees, on-chain limit orders, TWAP, and other customizable logic. At the same time, through Singleton architecture and Flash Accounting technology, gas costs were reduced by over 99%. v4 retains the capital efficiency advantages of v3 and enhances flexibility and programmability, becoming an important part of DeFi innovation infrastructure.

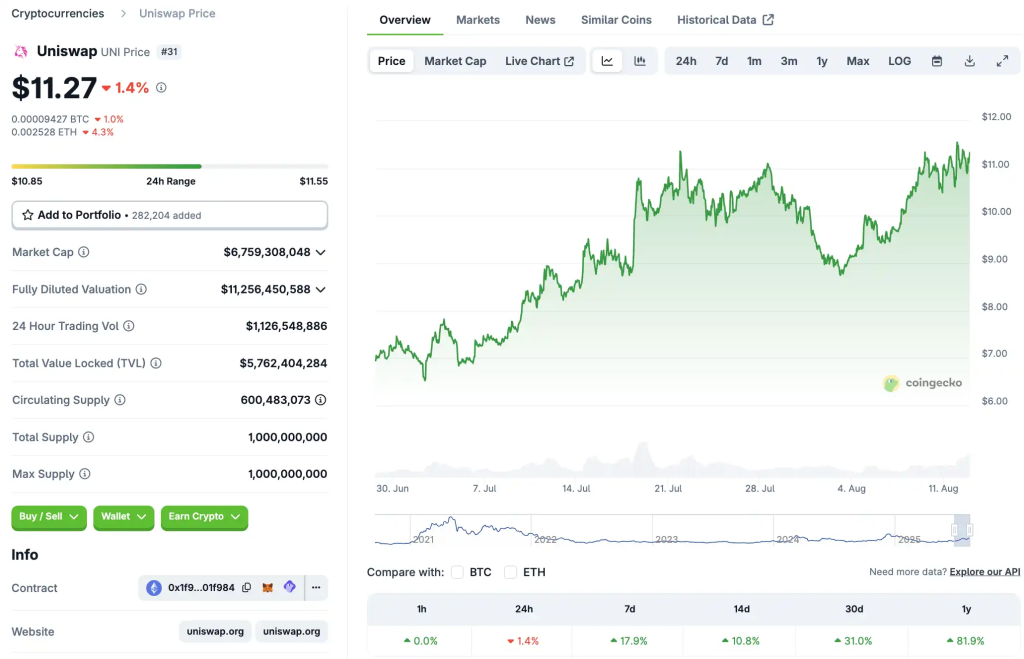

Recently, Uniswap has shown steady performance: UNI's price is currently $11.27, with a 30-day increase of approximately 31%, and its market cap has re-entered the $670 million range.

The factors behind UNI's rise include:

1. Strong TVL rebound

v4 broke through $1 billion TVL at an astonishing speed, providing solid emotional support for UNI's price and demonstrating the recovery trend of the DeFi ecosystem.

2. Hooks innovation attracts capital

Programmable liquidity strategies have enabled various strategy projects (such as Bunni, EulerSwap) to rapidly emerge, driving user participation and operational depth.

3. Unichain expands its role

The new network brings lower costs and efficient experiences, creating new growth engines for Uniswap and further increasing activity.

4. Technological iteration and institutional upgrades

v4 introduces smart wallet support, cross-chain integration (such as Hyperbridge, LayerZero), and over 640 million+ swap transactions, building a more comprehensive trading infrastructure.

Currently, Uniswap v4 TVL has broken through the $1 billion milestone. In terms of cumulative trading volume, Uniswap has exceeded $11 billion, serving as a core liquidity hub in DeFi. Among them, Unichain accounts for about 75% of daily trading volume, while Ethereum accounts for 15–20%. Regarding the deployment of Hooks, over 2,500 Hook liquidity pools have been launched, among which Bunni and EulerSwap have cumulative trading volumes exceeding $1 billion each.

Although Fluid is shining brightly in the market, Uniswap remains a steady and powerful player: Its v4 version continues to consolidate its core position in DeFi through technological innovation and ecosystem expansion. Rapid TVL growth and rich Hooks applications are the important foundations for its revival. However, technical indicators such as RSI are high, suggesting potential profit-taking pressure in the short term.

Whether it can continue to rise depends on: Whether Hook strategy pools can bring new growth; whether cross-chain integration deepens ecological collaboration; and whether Unichain can maintain its cost advantage and attractiveness, potentially challenging the $13–$14 range.

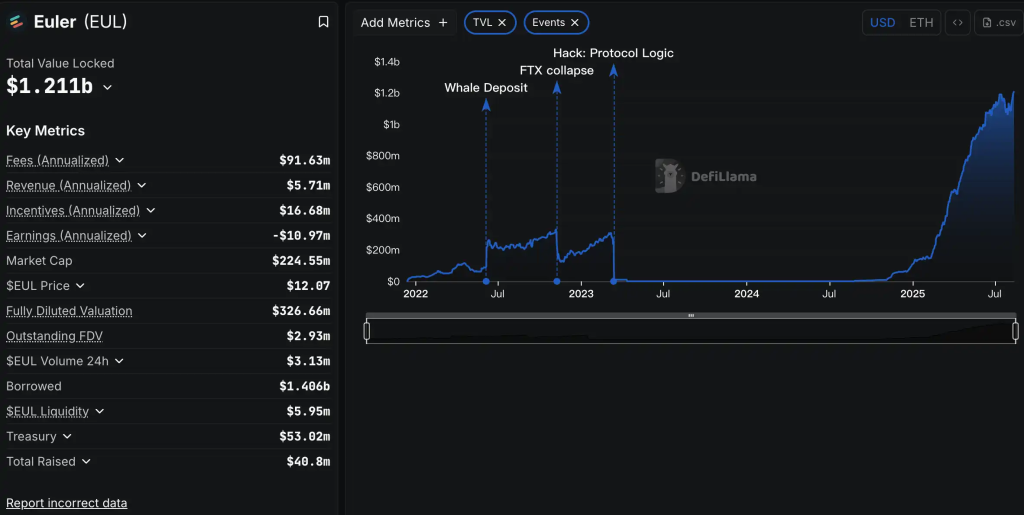

Euler: "Rebirth after the hacker attack"

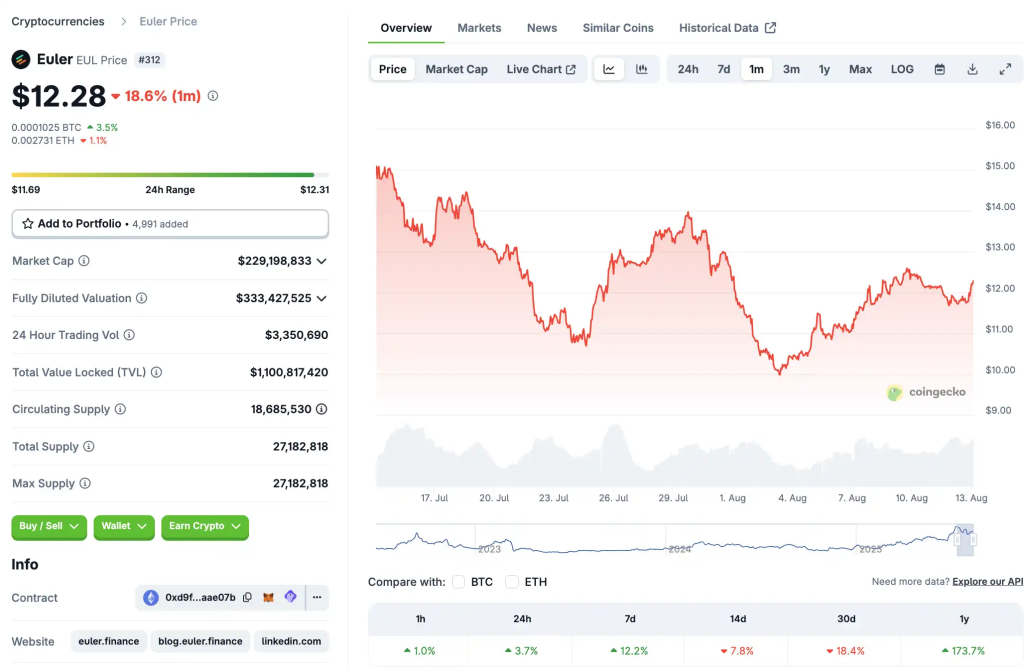

Euler Finance is a modular lending protocol on Ethereum, known for its risk stratification, flexible asset permissions, and high capital efficiency. It supports any ERC-20 asset, leveraged position management, and complex liquidation protection mechanisms. After being hit by a hacking incident in 2024, the project quickly restarted, regaining "trust high ground," becoming one of the core forces in the DeFi lending field's resurgence.

Recently, $EUL reached a new all-time high, with the price breaking above $15, rising over 950% from its low point at the end of 2023. Its market cap has also approached $300 million. Although there has been a slight correction, the current price is stable in the $11.8–$13 range.

The factors behind Euler's rise include:

1. Rebirth from ashes

Euler quickly restarted after the hacking incident, winning community trust and capital return, forming the important foundation for its significant rebound.

2. Dual-line recovery of TVL and lending depth

Abnormal growth in TVL and a sharp increase in active loans reflect strong user loan demand and the revival of protocol momentum.

3. EulerSwap completes the ecosystem

After launching its native DEX, Euler built a self-circulating liquidity path, enabling closed-loop linkage between staking, lending, and trading.

4. Support from mainstream platforms increases

New information indicates that Coinbase will support EUL. After the announcement, the price rose by about 5.7% in one day, reflecting increased recognition from the capital market.

Disclaimer: Contains third-party opinions, does not constitute financial advice

Alpha Research

Alpha New Token Research Report, Binance Alpha Operation Suggestions

Popular Airdrop Tutorial

Selected potential airdrop opportunities to gain big with small investments

Crypto-linked Stocks

Crypto-stock linkage, real-time market quotes and in-depth analysis

Market Analysis

BTC/ETH, Major Cryptocurrencies, and Hot Altcoins Price Trends

Regulatory Watch

American Crypto Act – timely interpretations of policies worldwide

Frontier Insights

Spotlight on Frontier, trending projects, and breaking events

Crypto Weekly

Tracking on-chain movements of the smart money and institutions

ChainThink App

WeChat Official Account

WeChat Customer Service