Arbitrage Strategy: Binance USDC 12% Annualized Strategy

2025-08-12 17:23

The Ant Group has already denied the rumors this morning:

The information circulating online about China Rare Earth co-building the world's first rare earth RMB stablecoin is a rumor. Investors are reminded to be cautious of false information being used for hype and investment manipulation, to avoid unnecessary losses.

With the surge in stablecoins in Hong Kong, more scams disguised as stablecoins have emerged domestically, promising high returns, zero risk annualized yields, etc. Remember that there is no such thing as a free lunch.

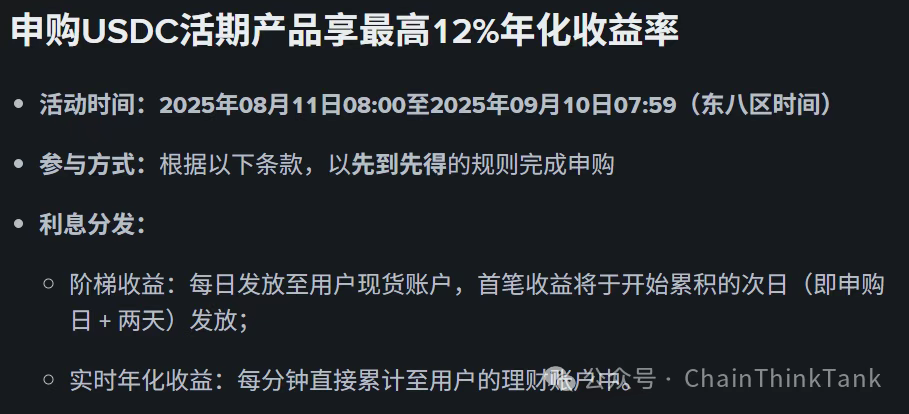

At the same time today, another piece of news has gone viral. Binance Exchange has launched a special campaign for the USDC principal-guaranteed coin earning flexible deposit product. According to its announcement, this campaign lasts for one month with a tiered yield structure. Users with up to 100,000 USD can enjoy an annualized interest rate of up to 12%.

12% annualized yield? For 100,000 USD, you can earn nearly 1,000 USD in one month, equivalent to over 7,000 RMB.

Many community members asked today, curious about how such a high annualized yield is achieved.

In fact, this is essentially an advertising campaign. The parent company of USDC, CICRL, has already listed on the US stock market. In fact, before this campaign, it had already conducted high-interest activities on many overseas compliant exchanges, such as Coinbase, a U.S.-listed company, and Kraken in Europe.

However, due to Binance's compliance reasons, it has not yet launched such activities. This time, it is estimated that they will start cooperating with Binance. The funding source for such a high annualized interest rate is definitely not provided by the exchange itself, but supported by CICRL behind it.

This also reveals the situation in the stablecoin market.

One super (USDT), one strong (USDC), a battle among many (USDE, FDUSD, etc.), and new entrants constantly emerging (USD1).

Everyone wants to expand their territory and increase their market share and popularity. Therefore, they have to compete by burning money.

Currently, USDC offers an annualized yield of up to 12% for 100,000 USD. The loan interest rate for 100,000 USD from banks is 3%.

For one month: 100,000 * 12% / 12 - 100,000 * 3% / 12 = 750 USD

No matter what, everyone should remember that investment involves risks and that entering the market requires caution. Many online bloggers teach people how to cycle loans and how to pledge assets to gain interest. These are all high-risk operations.

Some even suggest taking loans to get involved. There is no need for that. Although the interest is high, there are still risks such as exchange rate loss and platform compliance issues. Be careful not to blindly follow others' advice and invest recklessly.

Disclaimer: Contains third-party opinions, does not constitute financial advice

Alpha Research

Alpha New Token Research Report, Binance Alpha Operation Suggestions

Popular Airdrop Tutorial

Selected potential airdrop opportunities to gain big with small investments

Crypto-linked Stocks

Crypto-stock linkage, real-time market quotes and in-depth analysis

Market Analysis

BTC/ETH, Major Cryptocurrencies, and Hot Altcoins Price Trends

Regulatory Watch

American Crypto Act – timely interpretations of policies worldwide

Frontier Insights

Spotlight on Frontier, trending projects, and breaking events

Crypto Weekly

Tracking on-chain movements of the smart money and institutions

ChainThink App

WeChat Official Account

WeChat Customer Service