Can Retail Investors Buy SpaceX Equity? An Overview of Three Private Equity Tokenization Platforms

2025-06-27 09:30

Outside the stablecoin craze, equity tokenization is becoming a new market narrative.

On June 27, Web3 startup Jarsy announced a $5 million Pre-seed funding led by Breyer Capital. More than the amount, what truly caught the market's attention was the problem they are trying to solve: why do the early growth dividends of top private companies always belong only to institutions and super-rich individuals? Jarsy's answer is to restructure participation methods using blockchain technology — to "mint" private equity of unlisted companies into asset-backed tokens, allowing ordinary people to bet on the growth of star companies like SpaceX and Stripe with a $10 threshold.

After the funding disclosure, the market immediately focused on the topic of "private equity tokenization" — this alternative asset class, once only present in VC meeting rooms and high-net-worth circles, is now being packaged as blockchain assets and expanding on-chain.

Private Equity Tokenization: The Next Step in Asset On-Chain

If there are still unexplored financial opportunities in this era, the private market is undoubtedly the most representative asset island.

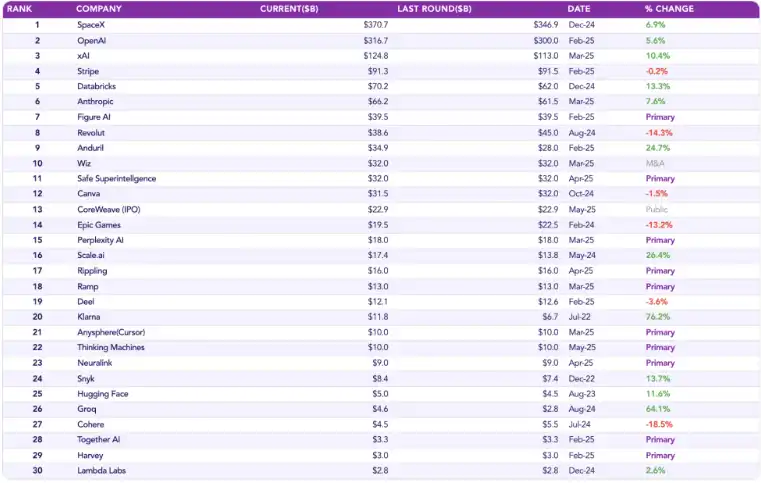

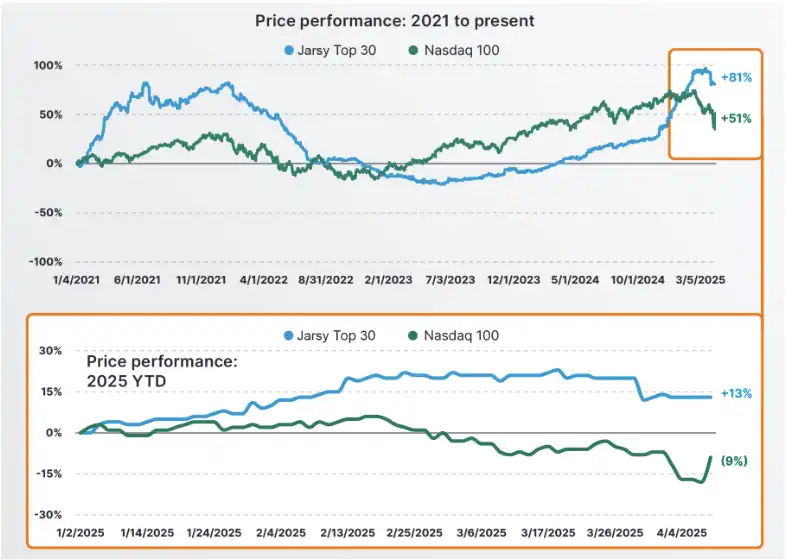

Jarsy has built a metrics system covering the 30 most active and transactional unlisted companies in the private market, known as the "Jarsy 30 Index," used to measure the overall performance of top Pre-IPO companies. This index focuses on star companies such as SpaceX and Stripe, representing the most imaginative and capital-focused part of the private market. Data shows that these companies have sufficiently attractive returns.

From early 2021 to Q1 2025, the Jarsy 30 Index rose 81%, far exceeding the 51% rise of the Nasdaq 100 Index during the same period. Even against the backdrop of a general market downturn in Q1 2025, with the Nasdaq falling 9%, these top unlisted companies still rose 13%. This strong contrast is not just a confirmation of the company's fundamentals but also a market vote on the growth potential before IPO — these assets are still in the golden phase of the most significant value mispricing.

But the problem lies in this "value capture window" being accessible only to a few. An asset market with an average transaction size over $3 million, complex structures (often requiring SPVs), and lack of public liquidity is completely an "observation zone" for most retail investors.

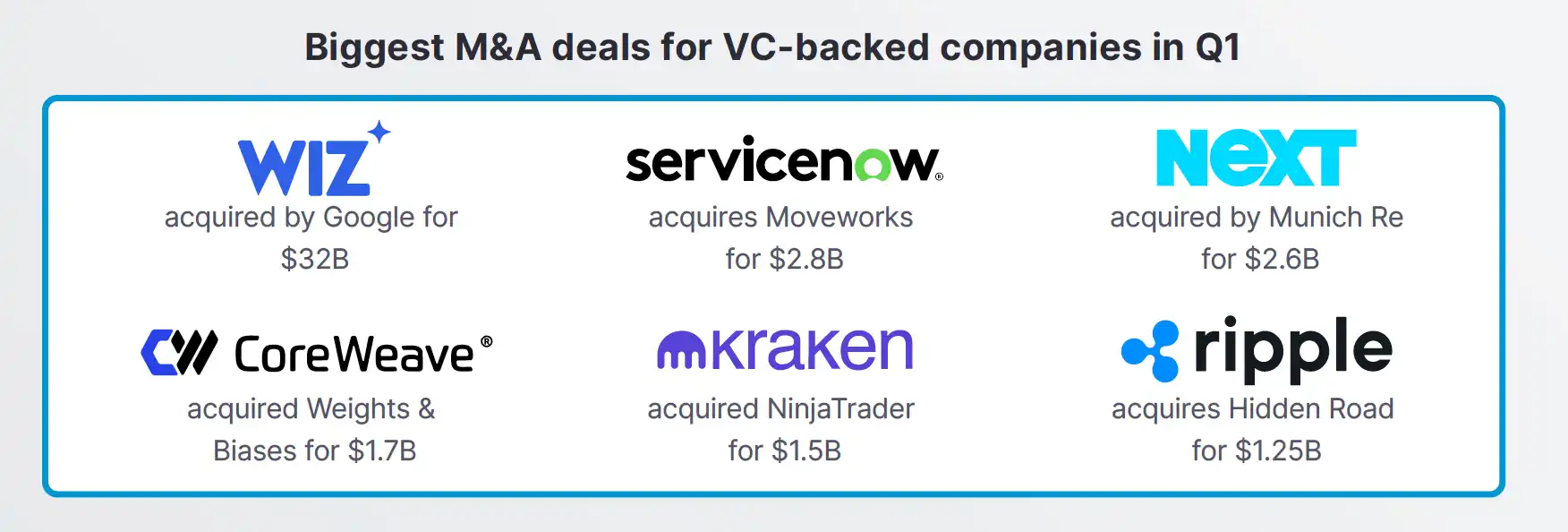

Additionally, the exit paths of these companies are often not limited to IPOs, and M&A has become one of the more mainstream options, further increasing the entry barrier for retail investors. In Q1 2025 alone, the M&A volume of venture-backed companies reached a record high of $54 billion, with Google's acquisition of cybersecurity unicorn Wiz alone accounting for $3.2 billion.

Thus, we see a typical traditional finance picture, where the most valuable growth assets are locked within the circles of high-net-worth individuals and institutions, while ordinary investors are excluded.

"Private equity tokenization" is breaking this structural inequality, decomposing previously high-barrier, low-liquidity, complex and opaque private equity into on-chain native assets, lowering the entry barriers, compressing the $3 million entrance ticket to $10; transforming lengthy and complex SPV agreements into on-chain smart contracts; and simultaneously enhancing liquidity, enabling originally long-cycle closed assets to be priced around the clock.

Putting the "capital feast" of the primary market into everyone's digital wallet.

Jarsy

As a blockchain-based asset tokenization platform, Jarsy aims to break down the walls of the traditional financial world, making Pre-IPO assets that were once exclusive to high-net-worth individuals available as publicly accessible investment products for global users. Its vision is clear: to make investing no longer restricted by capital thresholds, geographic barriers, or regulatory labels, redistributing financial opportunities to the masses.

Its operational mechanism is straightforward and powerful. Jarsy first completes the real equity purchase of the target company on the platform, then maps this equity onto the chain in a 1:1 form through tokens. This is not merely a securities mirroring, but a substantive transfer of economic rights. More importantly, all token issuance volumes, circulation paths, and holding information are transparently recorded on the chain, open for any user to verify in real-time. On-chain traceability and off-chain physicality achieve a technical restructuring of traditional SPV and fund systems in structure.

At the same time, Jarsy does not push retail investors into the "deep waters" of professional and complex processes. The platform takes on all the "dirty work," such as due diligence, structural design, legal custody, etc., allowing users to build their own Pre-IPO investment portfolios with a minimum purchase of $10 using credit cards or USDC. The complex risk control and compliance processes are "invisible" to users.

In this model, token prices are highly tied to company valuations, and users' returns come from the actual growth curve of real companies, not the empty narratives of the platform. This architecture not only enhances the authenticity of investments but also opens up the long-controlled revenue channel between retail investors and the primary market at the mechanism level.

Republic

On June 25, Republic, a veteran investment platform, announced the launch of a new product line — Mirror Tokens. The first product, rSpaceX, uses the Solana blockchain to attempt to "mirror" one of the most imaginative companies in the world, "SpaceX," into a publicly accessible on-chain asset. Each rSpaceX token is tied to the expected value movement of SpaceX, a $350 billion valuation aerospace unicorn. The minimum investment threshold is only $50, and it supports Apple Pay and stablecoin payments, opening the gates of the primary market for global retail investors.

Different from traditional private equity investments, Mirror Tokens do not grant you voting rights, but they have designed a unique "tracker" mechanism: the tokens issued by Republic are essentially debt instruments dynamically linked to the valuation of the target company. When SpaceX achieves an IPO, is acquired, or experiences other "liquidity events," Republic will return corresponding stablecoin earnings to investors' wallets according to the token holding ratio, including possible dividends. This is a new structure where you can "dividend without holding shares," maximizing the reduction of legal obstacles while retaining core revenue exposure.

Of course, the mechanism is not without its own barriers. All Mirror Tokens will be locked for 12 months after initial issuance before they can circulate in the secondary market. On the regulatory front, rSpaceX is sold under the U.S. Regulation Crowdfunding rules, allowing any investor to participate globally, but specific qualifications will be dynamically screened based on local laws.

More excitingly, this is just the beginning. Republic has announced that it will subsequently launch Mirror Tokens pegged to star private companies such as Figma, Anthropic, Epic Games, and xAI, even allowing users to nominate the next "unlisted unicorn" they want to bet on. From structural design to distribution mechanisms, Republic is building an on-chain private equity parallel market that doesn't require waiting for an IPO.

Tokeny

Tokeny, a RWA asset tokenization solution provider based in Luxembourg, has also entered the private market securitization sector. In June 2025, Tokeny partnered with the local digital securities platform Kerdo, aiming to reshape the way European professional investors participate in the private market (such as real estate, private equity, hedge funds, and private debt) using blockchain infrastructure.

Its core advantage lies in standardized product structures, embedded compliance logic in the issuance process, and the ability to quickly replicate and expand across different jurisdictions using Tokeny's white-label technology. Tokeny focuses on granting assets "institutional-level legitimacy" — the ERC-3643 standard it uses allows tokens to embed KYC, transfer restrictions, and other control logic throughout the entire generation and transfer process, ensuring product legality and transparency while allowing investors to self-verify security on-chain without relying on platform endorsement.

With increasingly strict regulatory frameworks such as MiFID II, the demand for such "compliant on-chain assets" in the European market is accelerating. Tokeny is filling the trust vacuum between institutional investors and on-chain assets in a highly technical way. Behind this collaboration, a trend is reflected: competition in the RWA space is no longer just about on-chain technological implementation, but about who can master the combination of regulation + standardized product structures + multiple jurisdiction distribution channels. The partnership between Tokeny and Kerdo is a typical example of this trend.

Summary

The rise of private equity tokenization signals that the primary market is entering a new stage of structural transformation driven by blockchain technology. However, this path is still filled with real-world resistance. It may reshape access rules, but it cannot instantly break through deep-seated structural barriers between retail investors and institutions. RWA is not a "magic key," but rather a long-term game of trust, transparency, and institutional restructuring. The real test has only just begun.

Disclaimer: Contains third-party opinions, does not constitute financial advice

Alpha Research

Alpha New Token Research Report, Binance Alpha Operation Suggestions

Popular Airdrop Tutorial

Selected potential airdrop opportunities to gain big with small investments

Crypto-linked Stocks

Crypto-stock linkage, real-time market quotes and in-depth analysis

Market Analysis

BTC/ETH, Major Cryptocurrencies, and Hot Altcoins Price Trends

Regulatory Watch

American Crypto Act – timely interpretations of policies worldwide

Frontier Insights

Spotlight on Frontier, trending projects, and breaking events

Crypto Weekly

Tracking on-chain movements of the smart money and institutions

ChainThink App

WeChat Official Account

WeChat Customer Service